Question: Learning Objective: 05-04 Identify Factors Used to Evaluate Different Savings Plans 77.op 157 The Federal Deposit Insurance Corporation insures deposits up to $250,000 per person

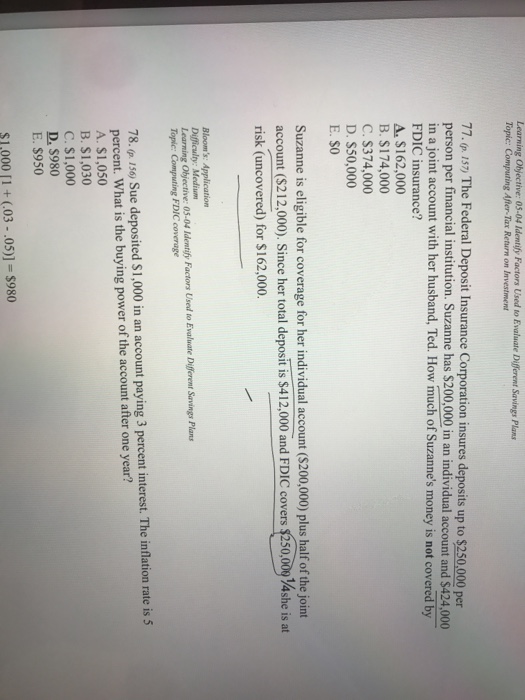

Learning Objective: 05-04 Identify Factors Used to Evaluate Different Savings Plans 77.op 157 The Federal Deposit Insurance Corporation insures deposits up to $250,000 per person per financial institution. Suzanne has $200,000 in an individual account and $424,000 in a joint account with her husband, Ted. How much of Suzanne's money is not covered by FDIC insurance? $ 1 62,000 B. $174,000 C. S374,000 D. S50,000 E. SO Suzanne is eligible for coverage for her individual account (S200,000) plus half of the joint account ($212,000). Since her total deposit is $412,000 and FDIC covers $250,00g /4she is at risk (uncovered) for $162,000. Bloom's Difficulty: Medium aumung hieve o5.o4 ldnis Factors Used to Eluate Drnt Srvings Plans Topic: Computing FDIC coverage 78.(p 156) Sue deposited $1,000 in an account paying 3 percent interest. The inflation rate is 5 percent. What is the buying power of the account after one year? A. $1,050 B. $1,030 C. $1,000 D, S980 E. $950 S 1,000 [l + (.03-.05)]-3980

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts