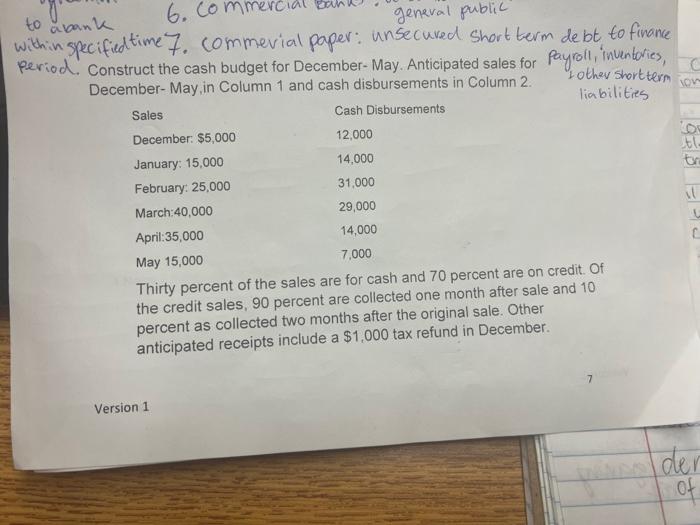

Question: to abank 6.00 general public within specified time 7. commerial paper: unsecured Short term debt to finance period. Construct the cash budget for December- May.

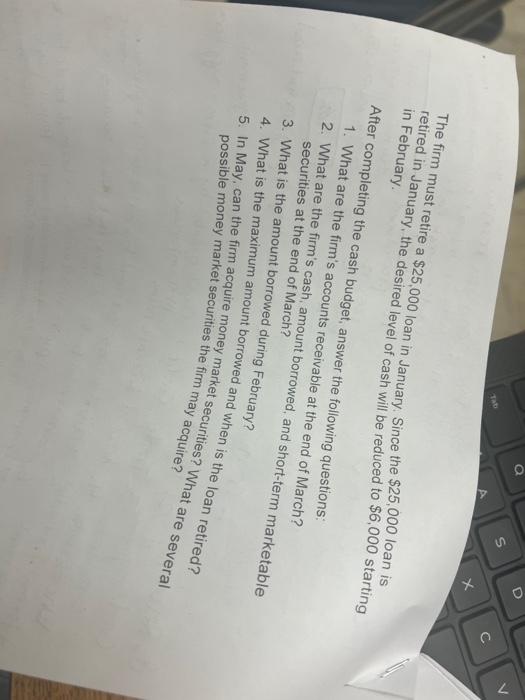

to abank 6.00 general public within specified time 7. commerial paper: unsecured Short term debt to finance period. Construct the cash budget for December- May. Anticipated sales for Payroll, inventories, December- May,in Column 1 and cash disbursements in Column 2. C tother short term on liabilities Sales Cash Disbursements December: $5,000 12,000 Lor tl. January: 15,000 14,000 February: 25,000 31,000 March:40,000 29,000 April:35,000 14,000 May 15,000 7,000 Thirty percent of the sales are for cash and 70 percent are on credit. Of the credit sales, 90 percent are collected one month after sale and 10 percent as collected two months after the original sale. Other anticipated receipts include a $1,000 tax refund in December. Version 1 PEE C Ider of a s Tat The firm must retire a $25,000 loan in January. Since the $25,000 loan is retired in January, the desired level of cash will be reduced to $6,000 starting in February After completing the cash budget, answer the following questions: 1. What are the firm's accounts receivable at the end of March? 2. What are the firm's cash amount borrowed, and short-term marketable securities at the end of March? 3. What is the amount borrowed during February? 4. What is the maximum amount borrowed and when is the loan retired? 5. In May, can the firm acquire money market securities? What are several possible money market securities the firm may acquire ? to abank 6.00 general public within specified time 7. commerial paper: unsecured Short term debt to finance period. Construct the cash budget for December- May. Anticipated sales for Payroll, inventories, December- May,in Column 1 and cash disbursements in Column 2. C tother short term on liabilities Sales Cash Disbursements December: $5,000 12,000 Lor tl. January: 15,000 14,000 February: 25,000 31,000 March:40,000 29,000 April:35,000 14,000 May 15,000 7,000 Thirty percent of the sales are for cash and 70 percent are on credit. Of the credit sales, 90 percent are collected one month after sale and 10 percent as collected two months after the original sale. Other anticipated receipts include a $1,000 tax refund in December. Version 1 PEE C Ider of a s Tat The firm must retire a $25,000 loan in January. Since the $25,000 loan is retired in January, the desired level of cash will be reduced to $6,000 starting in February After completing the cash budget, answer the following questions: 1. What are the firm's accounts receivable at the end of March? 2. What are the firm's cash amount borrowed, and short-term marketable securities at the end of March? 3. What is the amount borrowed during February? 4. What is the maximum amount borrowed and when is the loan retired? 5. In May, can the firm acquire money market securities? What are several possible money market securities the firm may acquire

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts