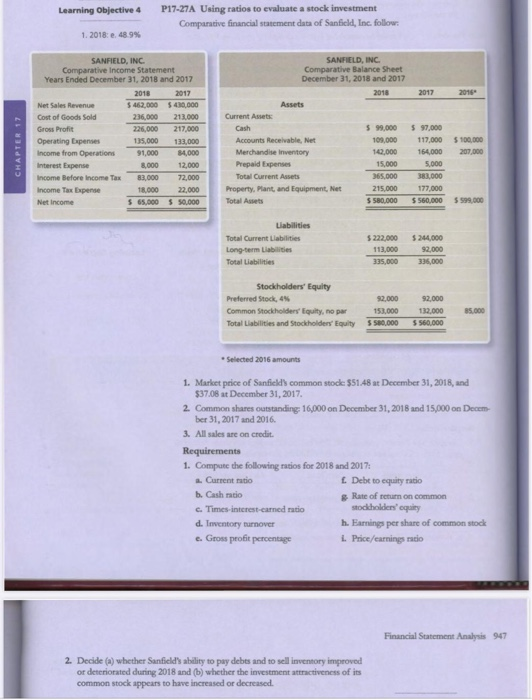

Question: Learning Objective 4 P17-27A Using ratios to evaluate a stock investment Comparative financial statement data of Sanfield, Inc. follow. 1. 2018: 48.9% 2017 2016 SANFIELD,

Learning Objective 4 P17-27A Using ratios to evaluate a stock investment Comparative financial statement data of Sanfield, Inc. follow. 1. 2018: 48.9% 2017 2016 SANFIELD, INC Comparative Income Statement Years Ended December 31, 2018 and 2017 2018 2017 Net Sales Revenue $462,000 $400,000 Cost of Goods Sold 236,000 213.000 Gross Profit 226,000 217.000 Operating Expenses 135,000 133,000 Income from Operations 91,000 $4,000 Interest Expense 8.000 12.000 Income Before Income Tax 83,000 Income Tax Expense 18.000 22.000 Net Income $65.000 $ 90.000 SANFIELD, INC Comparative Balance Sheet December 31, 2018 and 2017 2018 Assets Current Assets Cash 599,000 Accounts Receivable, Net 109,000 Merchandise Inventory 14,000 Prepaid Expenses 15,000 Total Current Assets 365.000 Property Mant, and Equipment, Net 215.000 Total Assets $ 580,000 $100,000 207.000 $ 97,000 117,000 154 000 5.000 383,000 177.000 560,000 $ 599,000 Liabilities Total Current Liabilities Long-term Liabilities Total Liabilities $ 222.000 113,000 335,000 $244.000 92.000 336,000 Stockholders' Equity Preferred Stock, 4% Common Stockholders' Equity, no par Total Liabilities and Stockholders' Equity 92,000 153,000 580,000 92,000 132,000 $560,000 Selected 2016 amounts 1. Market price of Sanfield's common stock $51.48 at December 31, 2018, and $37.08 at December 31, 2017 2. Common shares outstanding: 16,000 on December 31, 2018 and 15,000 on Decem ber 31, 2017 and 2016. 3. All sales are on credit. Requirements 1. Compute the following ratios for 2018 and 2017: Current to Debt to cquity ratio b. Cash ratio Rate of return on common c. Times-interest-carned ratio stockholders' equity d. Inventory turnover h. Earnings per share of common stock e. Gross profit percentage 1. Price/earnings ratio Financial Statement Analysis 947 2. Decide (a) whether Sanfield's ability to pay debes and to sell inventory improved or deteriorated during 2018 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts