Question: Please help I will give a thumbs up if everything is good!!! (Click the icon to view the addition Comparative financial statement data of Dangerfield,

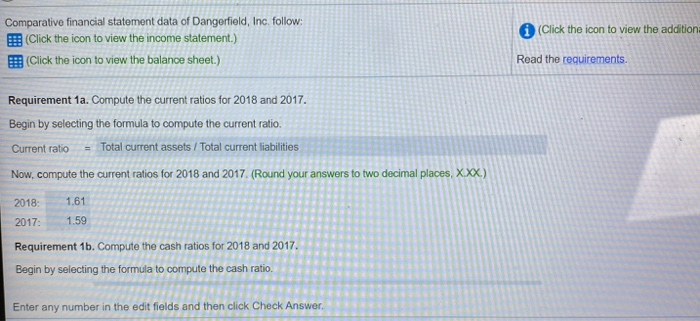

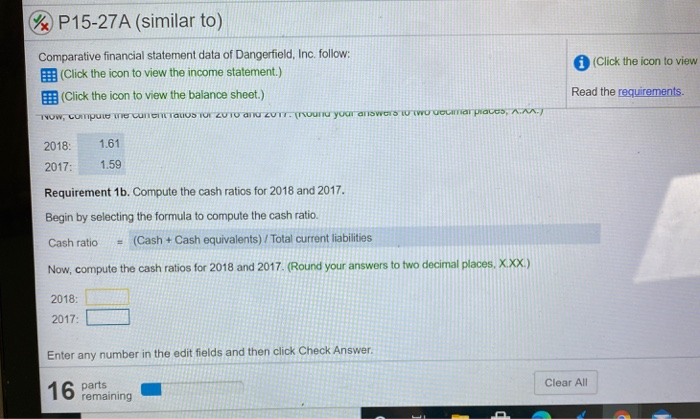

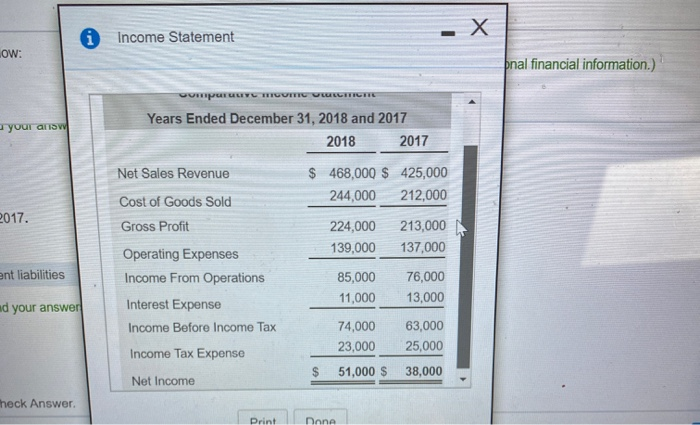

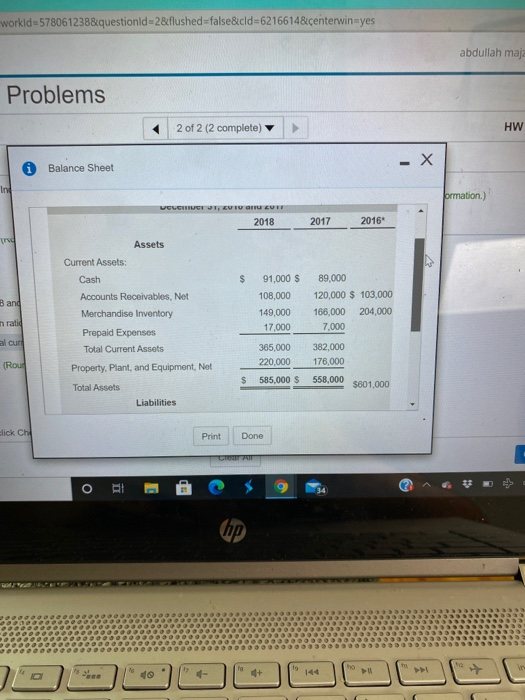

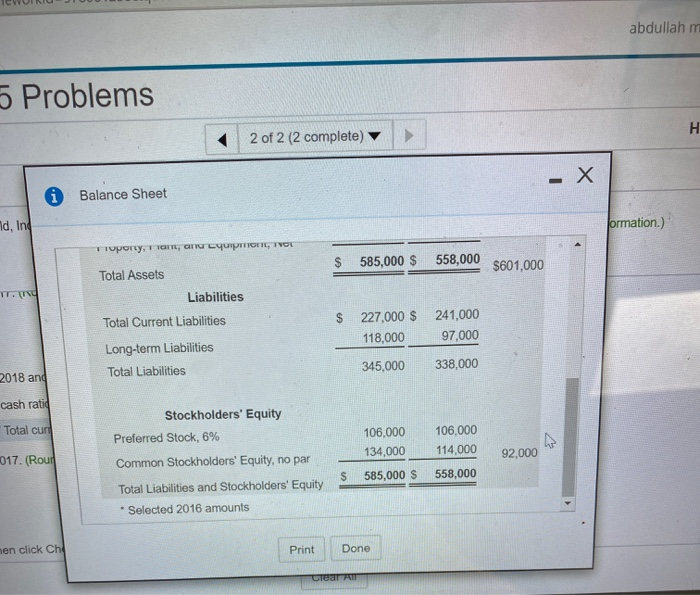

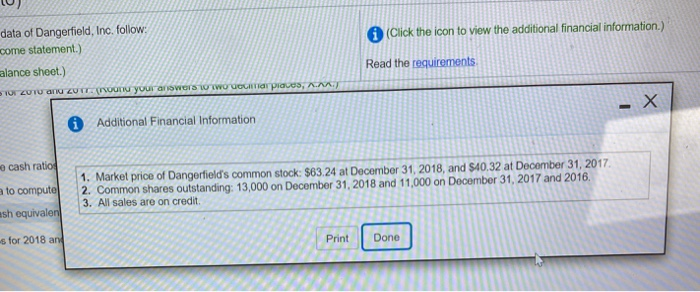

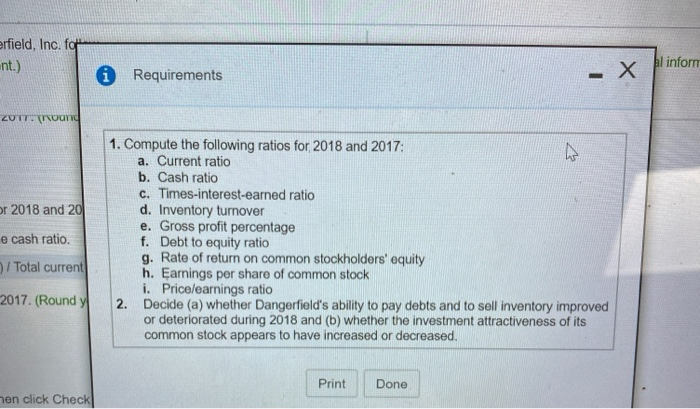

(Click the icon to view the addition Comparative financial statement data of Dangerfield, Inc. follow: (Click the icon to view the income statement.) Click the icon to view the balance sheet.) Read the requirements. Requirement 1a. Compute the current ratios for 2018 and 2017. Begin by selecting the formula to compute the current ratio. Current ratioTotal current assets / Total current liabilities Now, compute the current ratios for 2018 and 2017. (Round your answers to two decimal places, XXX.) 2018: 1.61 1.59 2017: Requirement 1b. Compute the cash ratios for 2018 and 2017 Begin by selecting the formula to compute the cash ratio. Enter any number in the edit fields and then click Check Answer, 2x P15-27A (similar to) (Click the icon to view Comparative financial statement data of Dangerfield, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the balance sheet.) Trow, compue con encaOD TOE ZOTO and ZTT. (round your answers WU voor places, A.N.) Read the requirements. 2018 1.61 2017 1.59 Requirement 1b. Compute the cash ratios for 2018 and 2017. Begin by selecting the formula to compute the cash ratio. Cash ratio = (Cash + Cash equivalents) / Total current liabilities Now, compute the cash ratios for 2018 and 2017. (Round your answers to two decimal places, X.XX) 2018 2017: Enter any number in the edit fields and then click Check Answer Clear All 16 parts remaining D Income Statement ow: bnal financial information.) Years Ended December 31, 2018 and 2017 2018 2017 your answ $ 468,000 $ 425,000 244,000 212,000 2017. 224,000 139,000 213,000 137,000 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Income From Operations Interest Expense Income Before Income Tax Income Tax Expense ent liabilities 85,000 11,000 76,000 13,000 nd your answer 74,000 23,000 63,000 25,000 $ 51,000 $ 38,000 Net Income heck Answer. Print none workid=5780612388.questionid=28flushed=false&cid=62166148/centerwinyes abdullah maja Problems 2 of 2 (2 complete) HW -X Balance Sheet Ing ormation) VELG JT, VIU CUTE 2018 2017 2016 The Assets Current Assets Cash $ Band 91,000 $ 108,000 149,000 17.000 Accounts Receivables, Net Merchandise Inventory Prepaid Expenses Total Current Assets 89,000 120,000 $ 103,000 166,000 204,000 7.000 n ratid alcun 382,000 176,000 (Rou 365.000 220,000 585,000 $ Property. Plant, and Equipment, Net S 558,000 Total Assets $601,000 Liabilities Slick Ch Print Done o RI hp ho 4+ > abdullah m 5 Problems H 2 of 2 (2 complete) - X Balance Sheet hd, Ind Jormation.) Tropory, Fan, ONLY TOTE, TVOL $ 585,000 $ 558,000 $601,000 TT. Total Assets Liabilities Total Current Liabilities $ 227,000 $ 118,000 241,000 97,000 Long-term Liabilities Total Liabilities 345,000 338,000 2018 and cash ratid Total curd Stockholders' Equity Preferred Stock, 6% Common Stockholders' Equity, no par 106,000 134,000 585,000 $ 106,000 114,000 92,000 017. (Rour $ 558,000 Total Liabilities and Stockholders' Equity * Selected 2016 amounts hen click Che Print Done LUUTA (Click the icon to view the additional financial information.) data of Dangerfield, Inc. follow: come statement.) alance sheet.) TO ZUTU and ZIT Moonu your answers to two Uliar piavos, ANA Read the requirements - Additional Financial Information cash ratio a to compute esh equivalen 1. Market price of Dangerfield's common stock: $63.24 at December 31, 2018, and $10.32 at December 31, 2017 2. Common shares outstanding: 13,000 on December 31, 2018 and 11,000 on December 31, 2017 and 2016, 3. All sales are on credit s for 2018 and Print Done erfield, Inc. for Ent.) al inform i Requirements ZOTT. TOUT N 2018 and 20 e cash ratio. 1. Compute the following ratios for 2018 and 2017: a. Current ratio b. Cash ratio C. Times-interest-earned ratio d. Inventory turnover e. Gross profit percentage f. Debt to equity ratio g. Rate of return on common stockholders' equity h. Earnings per share of common stock i. Pricelearnings ratio 2. Decide (a) whether Dangerfield's ability to pay debts and to sell inventory improved or deteriorated during 2018 and (b) whether the investment attractiveness of its common stock appears to have increased or decreased. / Total current 2017. (Round y Print Done hen click Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts