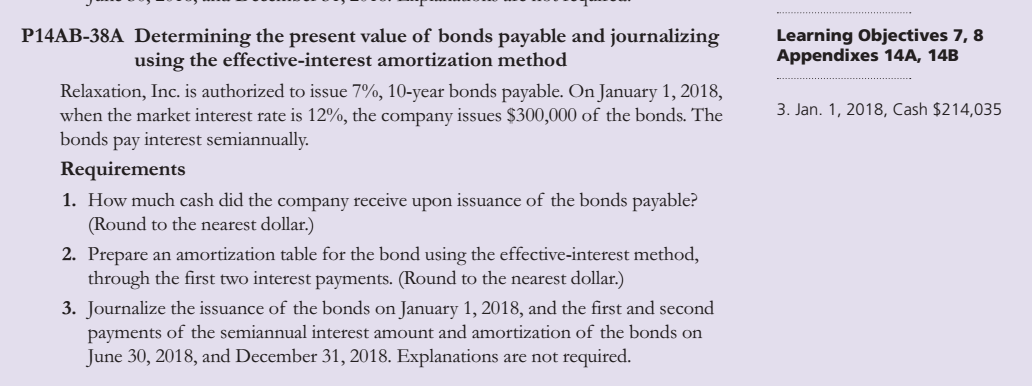

Question: Learning Objectives 7, 8 Appendixes 14A, 14B 3. Jan. 1, 2018, Cash $214,035 P14AB-38A Determining the present value of bonds payable and journalizing using the

Learning Objectives 7, 8 Appendixes 14A, 14B 3. Jan. 1, 2018, Cash $214,035 P14AB-38A Determining the present value of bonds payable and journalizing using the effective-interest amortization method Relaxation, Inc. is authorized to issue 7%, 10-year bonds payable. On January 1, 2018, when the market interest rate is 12%, the company issues $300,000 of the bonds. The bonds pay interest semiannually. Requirements 1. How much cash did the company receive upon issuance of the bonds payable? (Round to the nearest dollar.) 2. Prepare an amortization table for the bond using the effective-interest method, through the first two interest payments. (Round to the nearest dollar.) 3. Journalize the issuance of the bonds on January 1, 2018, and the first and second payments of the semiannual interest amount and amortization of the bonds on June 30, 2018, and December 31, 2018. Explanations are not required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts