Question: P14AB-45B Determining the present value of bonds payable and journalizing arningotvesB Objectives 7, 8 Appendixes 14A, 14B 018. using the effective-interest amortization method Sleep Well,

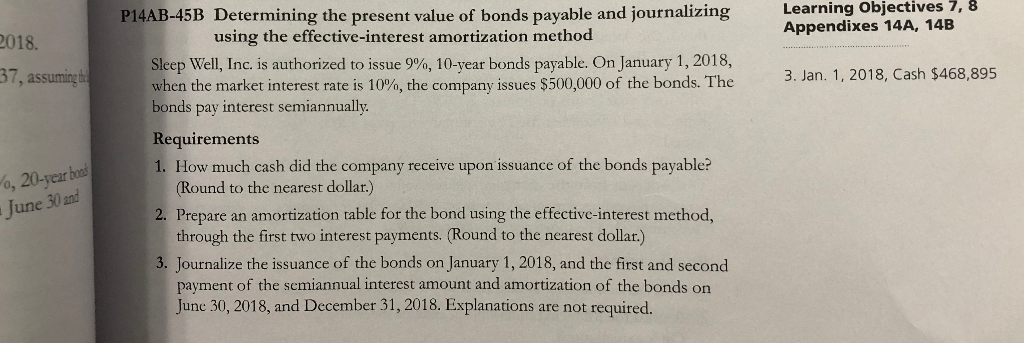

P14AB-45B Determining the present value of bonds payable and journalizing arningotvesB Objectives 7, 8 Appendixes 14A, 14B 018. using the effective-interest amortization method Sleep Well, Inc. is authorized to issue 9%, 10-year bonds payable. On January 1, 2018, when the market interest rate is 10%, the company issues $500,000 of the bonds. The bonds pay interest semiannually 37, assumingh 3. Jan. 1, 2018, Cash $468,895 Requirements 1. How much cash did the company receive upon issuance of the bonds payable? o, 20-year bad June 30 and Round to the nearest dollar.) through the first two interest payments. (Round to the nearest dollar.) payment of the semiannual interest amount and amortization of the bonds on 2. Prepare an amortization table for the bond using the effective-interest method, 3. Journalize the issuance of the bonds on January 1, 2018, and the first and second Junc 30, 2018, and December 31, 2018. Explanations are not required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts