Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lease contract between P (lessee) and Lease2U (lessor) is correctly classified as an operating lease P leased equipment from Lease2U on January 1, 2019

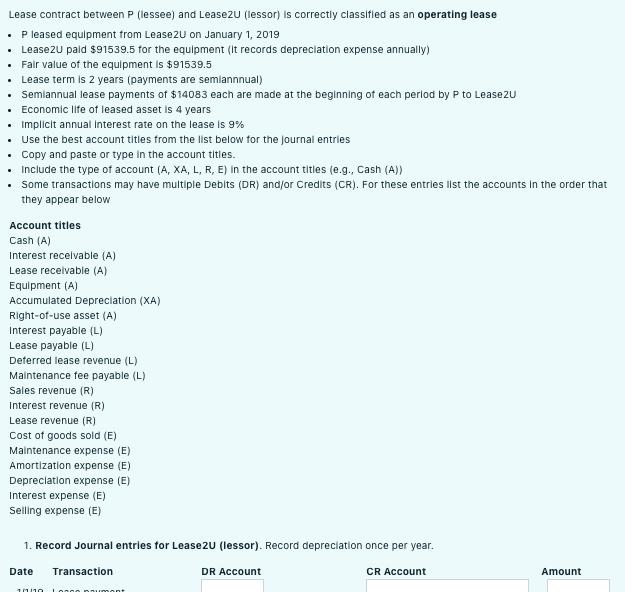

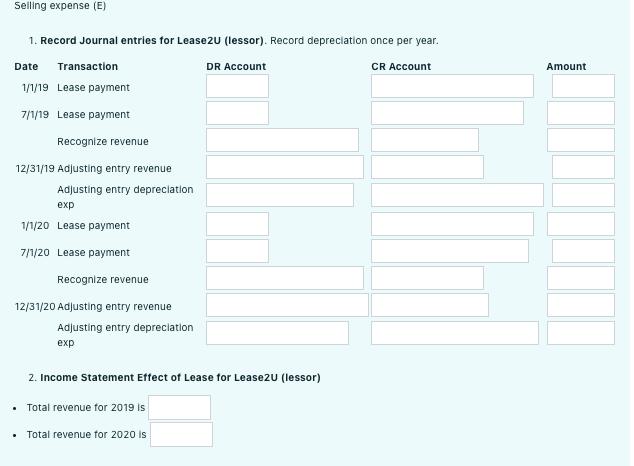

Lease contract between P (lessee) and Lease2U (lessor) is correctly classified as an operating lease P leased equipment from Lease2U on January 1, 2019 Lease2U paid $91539.5 for the equipment (It records depreciation expense annually) Fair value of the equipment is $91539.5 Lease term is 2 years (payments are semiannnual) Semiannual lease payments of $14083 each are made at the beginning of each period by P to LeaseZU Economic life of leased asset is 4 years Implicit annual Interest rate on the lease is 9% Use the best account titles from the list below for the journal entries Copy and paste or type in the account titles. Include the type of account (A, XA, L, R, E) in the account titles (e.g., Cash (A)) . Some transactions may have multiple Debits (DR) and/or Credits (CR). For these entries list the accounts in the order that they appear below Account titles Cash (A) Interest receivable (A) Lease receivable (A) Equipment (A) Accumulated Depreciation (XA) Right-of-use asset (A) Interest payable (L) Lease payable (L) Deferred lease revenue (L) Maintenance fee payable (L) Sales revenue (R) Interest revenue (R) Lease revenue (R) Cost of goods sold (E) Maintenance expense (E) Amortization expense (E) Depreciation expense (E) Interest expense (E) Selling expense (E) 1. Record Journal entries for Lease 2U (lessor). Record depreciation once per year. Date Transaction DR Account 10/10 Longe poumont CR Account Amount Selling expense (E) 1. Record Journal entries for Lease2U (lessor). Record depreciation once per year. DR Account CR Account Transaction 1/1/19 Lease payment 7/1/19 Lease payment Date Recognize revenue 12/31/19 Adjusting entry revenue Adjusting entry depreciation exp 1/1/20 Lease payment. 7/1/20 Lease payment Recognize revenue 12/31/20 Adjusting entry revenue Adjusting entry depreciation exp 2. Income Statement Effect of Lease for Lease2U (lessor) Total revenue for 2019 is Total revenue for 2020 is Amount

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Record The Journal Bate ililia 7119 f 123119 71120 Fransa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started