Question: Lecture 7 and Lecture 8 Discussion Question (For Reference) Today is March 19, 20X2. The partner calls you, CPA, into his office to discuss a

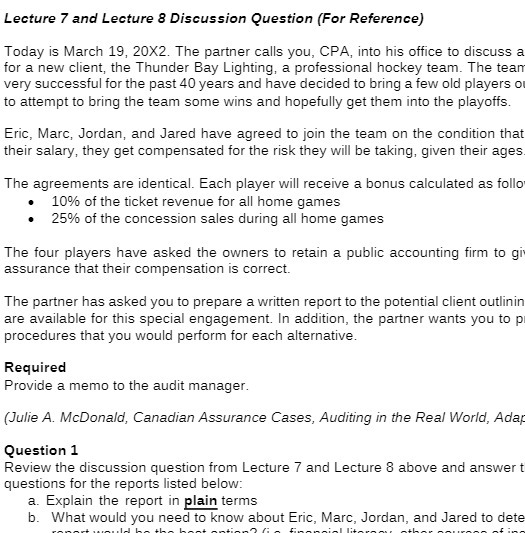

Lecture 7 and Lecture 8 Discussion Question (For Reference) Today is March 19, 20X2. The partner calls you, CPA, into his office to discuss a for a new client, the Thunder Bay Lighting, a professional hockey team. The tear very successful for the past 40 years and have decided to bring a few old players o to attempt to bring the team some wins and hopefully get them into the playoffs. Eric, Marc, Jordan, and Jared have agreed to join the team on the condition that their salary, they get compensated for the risk they will be taking, given their ages. The agreements are identical. Each player will receive a bonus calculated as follo 10% of the ticket revenue for all home games 25% of the concession sales during all home games The four players have asked the owners to retain a public accounting firm to gi assurance that their compensation is correct. The partner has asked you to prepare a written report to the potential client outlinin are available for this special engagement. In addition, the partner wants you to p procedures that you would perform for each alternative. Required Provide a memo to the audit manager. (Julie A. McDonald, Canadian Assurance Cases, Auditing in the Real World, Ada Question 1 Review the discussion question from Lecture 7 and Lecture 8 above and answer t questions for the reports listed below: a. Explain the report in plain terms b. What would you need to know about Eric, Marc, Jordan, and Jared to dete

Step by Step Solution

There are 3 Steps involved in it

Certainly Heres a draft you might consider for a memo to the audit manager regarding the engagement with the Thunder Bay Lighting Memo To Audit Manager From Your Name CPA Date Current Date Subject Spe... View full answer

Get step-by-step solutions from verified subject matter experts