Question: lem Saved Help Save & Exit Subr Check my work Damon, Inc., acquired 25% of Jolie Enterprises for $8,000,000 on October 1, 2018. The total

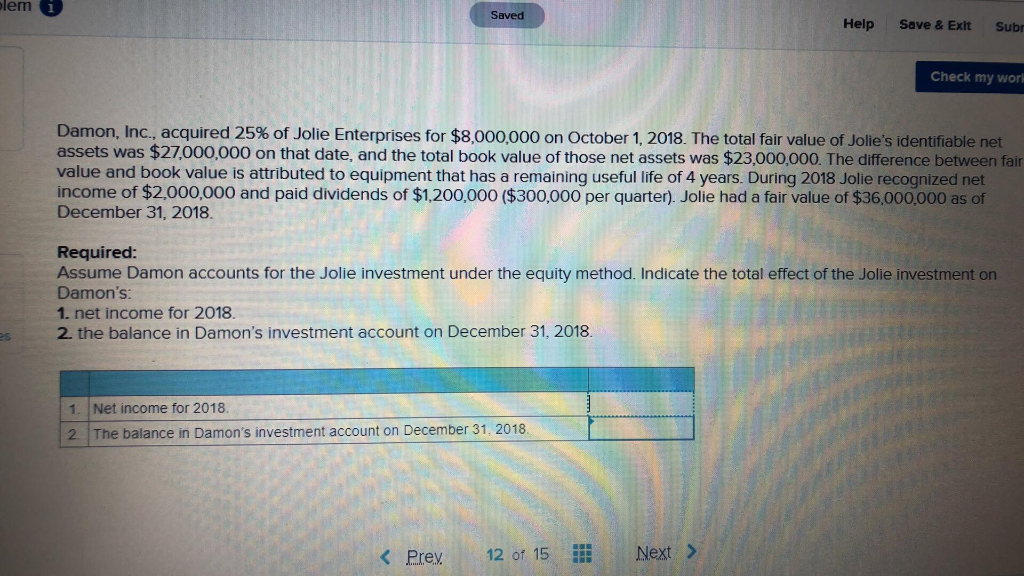

lem Saved Help Save & Exit Subr Check my work Damon, Inc., acquired 25% of Jolie Enterprises for $8,000,000 on October 1, 2018. The total fair value of Jolie's identifiable net assets was $27000,000 on that date, and the total book value of those net assets was $23,000,000. The difference between fair value and book value is attributed to equipment that has a remaining useful life of 4 years. During 2018 Jolie recognized net income of $2,000,000 and paid dividends of $1,200,000 ($300,000 per quarter). Jolie had a fair value of $36,000,000 as of December 31, 2018 Required: Assume Damon accounts for the Jolie investment under the equity method. Indicate the total effect of the Jolie investment on Damon's: 1. net income for 2018. 2. the balance in Damon's investment account on December 31, 2018. 1. Net income for 2018 2 The balance in Damon's investment account on December 31, 2018. Prey 12 of 15 Next>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts