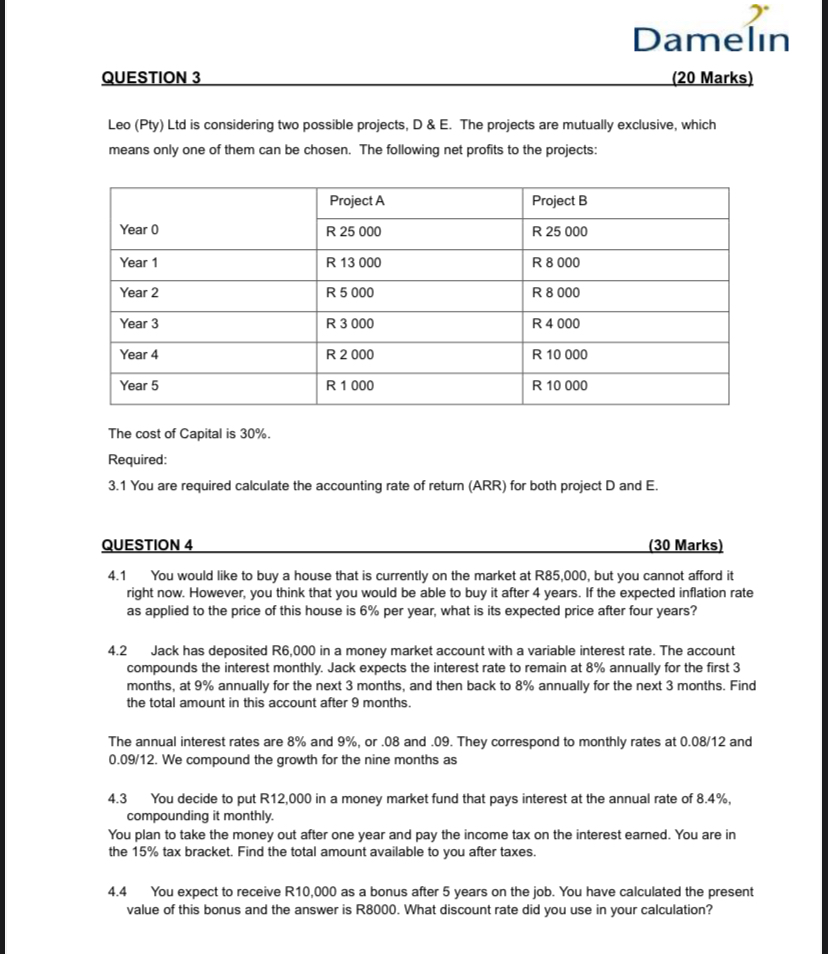

Question: Leo ( Pty ) Ltd is considering two possible projects, D & E . The projects are mutually exclusive, which means only one of them

Leo Pty Ltd is considering two possible projects, D & E The projects are mutually exclusive, which

means only one of them can be chosen. The following net profits to the projects:

The cost of Capital is

Required:

You are required calculate the accounting rate of return ARR for both project D and E

QUESTION

Marks

You would like to buy a house that is currently on the market at R but you cannot afford it

right now. However, you think that you would be able to buy it after years. If the expected inflation rate

as applied to the price of this house is per year, what is its expected price after four years?

Jack has deposited R in a money market account with a variable interest rate. The account

compounds the interest monthly. Jack expects the interest rate to remain at annually for the first

months, at annually for the next months, and then back to annually for the next months. Find

the total amount in this account after months.

The annual interest rates are and or and They correspond to monthly rates at and

We compound the growth for the nine months as

You decide to put R in a money market fund that pays interest at the annual rate of

compounding it monthly.

You plan to take the money out after one year and pay the income tax on the interest earned. You are in

the tax bracket. Find the total amount available to you after taxes.

You expect to receive R as a bonus after years on the job. You have calculated the present

value of this bonus and the answer is R What discount rate did you use in your calculation?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock