Question: less than 150wrds more than 100!! try using key terms if applicable please and thank you. 4. Check Table 10-4. You were told that fraud

less than 150wrds more than 100!! try using key terms if applicable please and thank you.

4. Check Table 10-4. You were told that fraud occurred in 1987 and 1988. With the help of my lecture, explain how the numbers in that table may signal fictitious sales/AR. (Hint: a. Explain how each of the six numbers reported for each of the two years in the table may indicate that fictitious sales occurred in these two years. b. Considering how making up bogus sales and committing fraud in processing sales returns may affect these numbers.)

key terms:

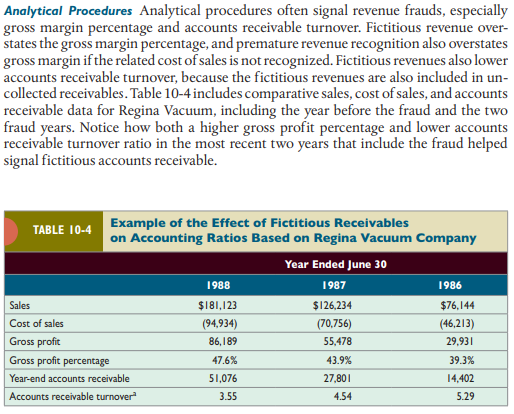

Analytical Procedures Analytical procedures often signal revenue frauds, especially gross margin percentage and accounts receivable turnover. Fictitious revenue over- states the gross margin percentage, and premature revenue recognition also overstates gross margin if the related cost of sales is not recognized. Fictitious revenues also lower accounts receivable turnover, because the fictitious revenues are also included in un- collected receivables. Table 10-4 includes comparative sales, cost of sales, and accounts receivable data for Regina Vacuum, including the year before the fraud and the two fraud years. Notice how both a higher gross profit percentage and lower accounts receivable turnover ratio in the most recent two years that include the fraud helped signal fictitious accounts receivable. TABLE 10-4 Example of the Effect of Fictitious Receivables on Accounting Ratios Based on Regina Vacuum Company Year Ended June 30 1988 1987 1986 Sales $181,123 $126,234 $76,144 Cost of sales (94,934) (70,756) (46,213) Gross profit 86,189 55,478 29,931 Gross profit percentage 47.6% 43.9% 39.3% Year-end accounts receivable 51,076 27,801 14,402 Accounts receivable turnover 3.55 4.54 5.29 Assessment inquiry-inquiry to corrobo- Informational inquiryinquiry to ob- rate or contradict prior information obtained tain information about facts and details the Earnings management-deliberate ac- auditor does not have tions taken by management to meet earn- Interrogative inquiry-inquiry used ings objectives to determine if the interviewee is being Fraud risk factors-entity factors that in- deceptive or purposefully omitting disclo- crease the risk of fraud sure of key knowledge of facts, events, or Fraud triangle represents the three con- circumstances ditions of fraud: incentives/pressures, op- Premature revenue recognition-rec- portunities, and attitudes/rationalization ognition of revenue before accounting Horizontal analysis analysis of per- standards requirements for recording rev- enue have been met centage changes in financial statement numbers compared to the previous period Vertical analysis-analysis in which Income smoothing form of earn- financial statement numbers are converted ings management in which revenues and to percentages of a base; also called com- mon-size financial statements expenses are shifted between periods to reduce fluctuations in earnings Analytical Procedures Analytical procedures often signal revenue frauds, especially gross margin percentage and accounts receivable turnover. Fictitious revenue over- states the gross margin percentage, and premature revenue recognition also overstates gross margin if the related cost of sales is not recognized. Fictitious revenues also lower accounts receivable turnover, because the fictitious revenues are also included in un- collected receivables. Table 10-4 includes comparative sales, cost of sales, and accounts receivable data for Regina Vacuum, including the year before the fraud and the two fraud years. Notice how both a higher gross profit percentage and lower accounts receivable turnover ratio in the most recent two years that include the fraud helped signal fictitious accounts receivable. TABLE 10-4 Example of the Effect of Fictitious Receivables on Accounting Ratios Based on Regina Vacuum Company Year Ended June 30 1988 1987 1986 Sales $181,123 $126,234 $76,144 Cost of sales (94,934) (70,756) (46,213) Gross profit 86,189 55,478 29,931 Gross profit percentage 47.6% 43.9% 39.3% Year-end accounts receivable 51,076 27,801 14,402 Accounts receivable turnover 3.55 4.54 5.29 Assessment inquiry-inquiry to corrobo- Informational inquiryinquiry to ob- rate or contradict prior information obtained tain information about facts and details the Earnings management-deliberate ac- auditor does not have tions taken by management to meet earn- Interrogative inquiry-inquiry used ings objectives to determine if the interviewee is being Fraud risk factors-entity factors that in- deceptive or purposefully omitting disclo- crease the risk of fraud sure of key knowledge of facts, events, or Fraud triangle represents the three con- circumstances ditions of fraud: incentives/pressures, op- Premature revenue recognition-rec- portunities, and attitudes/rationalization ognition of revenue before accounting Horizontal analysis analysis of per- standards requirements for recording rev- enue have been met centage changes in financial statement numbers compared to the previous period Vertical analysis-analysis in which Income smoothing form of earn- financial statement numbers are converted ings management in which revenues and to percentages of a base; also called com- mon-size financial statements expenses are shifted between periods to reduce fluctuations in earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts