Question: Less than five minutes tem Question Completion Status: Moving to another question will save this response. Question 15 of 20 Question 15 10 points On

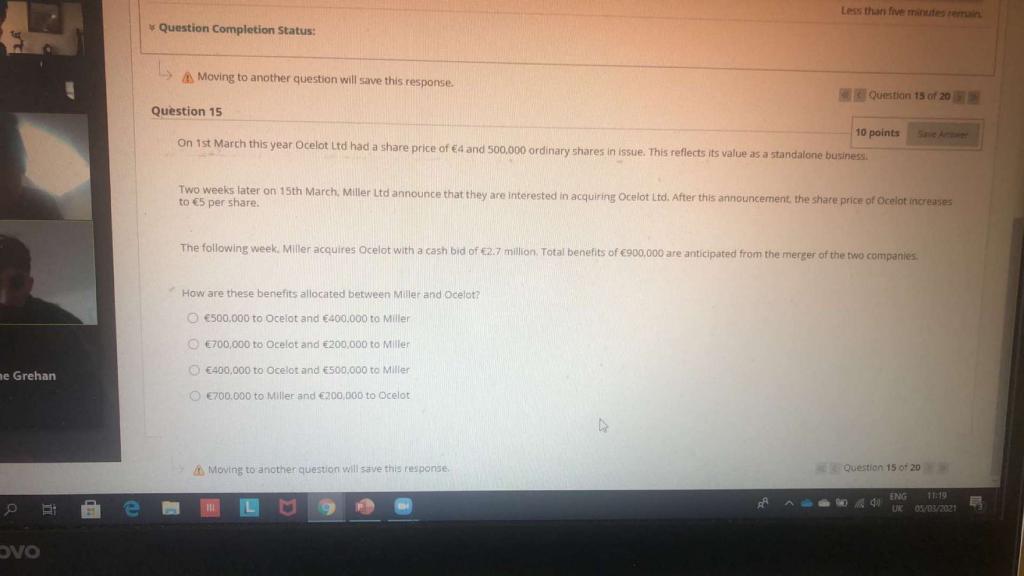

Less than five minutes tem Question Completion Status: Moving to another question will save this response. Question 15 of 20 Question 15 10 points On 1st March this year Ocelot Ltd had a share price of 4 and 500,000 ordinary shares in issue. This reflects its value as a standalone business Two weeks later on 15th March, Miller Ltd announce that they are interested in acquiring Ocelot Ltd. After this announcement the share price of Ocelot increases to 5 per share. The following week. Miller acquires Ocelot with a cash bid of 2.7 million. Total benefits of 900,000 are anticipated from the merger of the two companies. How are these benefits allocated between Miller and Ocelot? 500,000 to Ocelot and 400.000 to Miller 700,000 to Ocelot and 200,000 to Miller ne Grehan @ 400,000 to Ocelot and 500,000 to Miller 700,000 to Miller and 200,000 to Ocelot Moving to another question will save this response Question 15 of 20 DO ENG 10:19 UK 003/2021 OVO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts