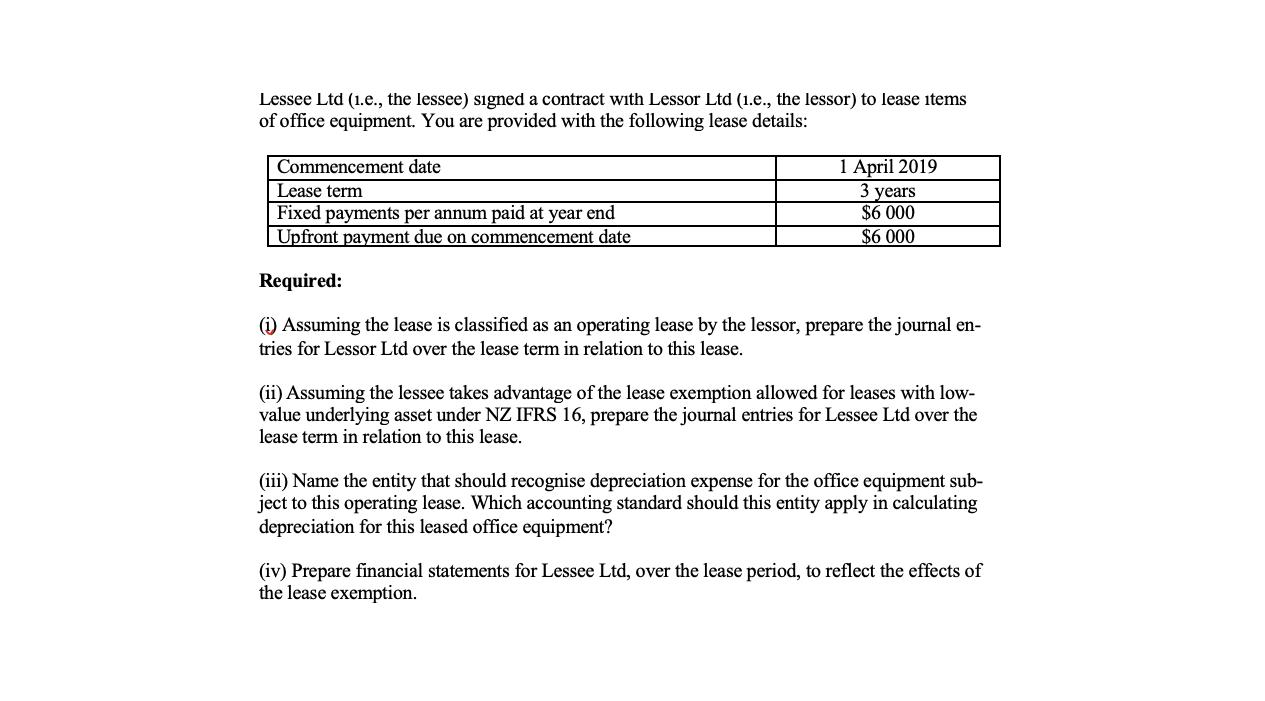

Question: Lessee Ltd (1.e., the lessee) signed a contract with Lessor Ltd (1.e., the lessor) to lease items of office equipment. You are provided with

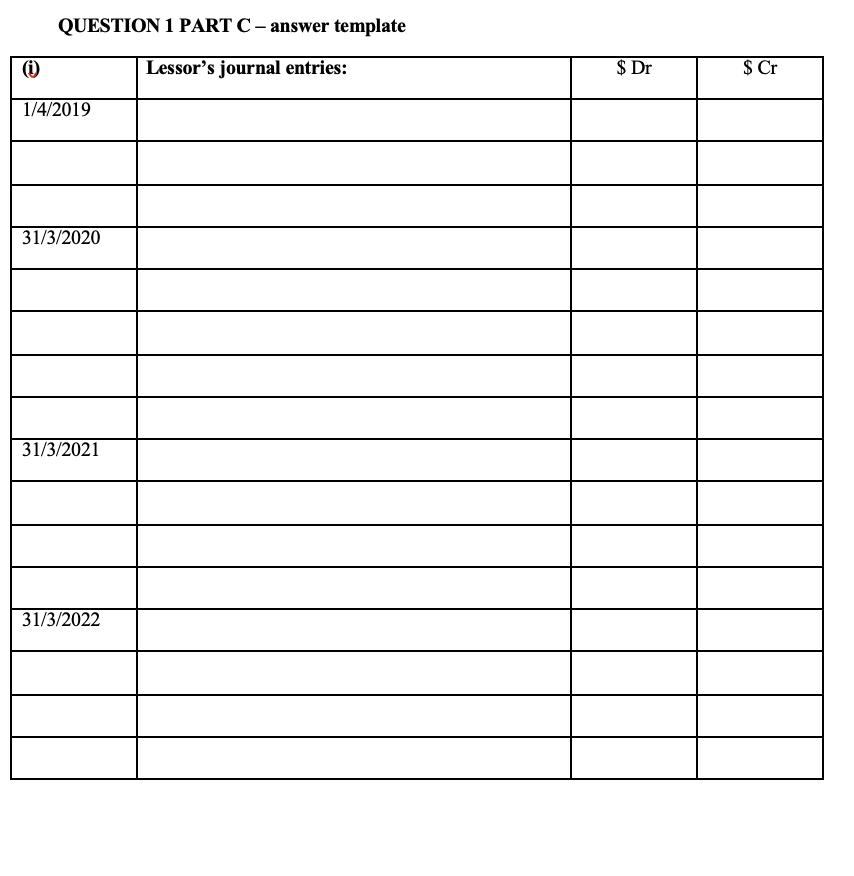

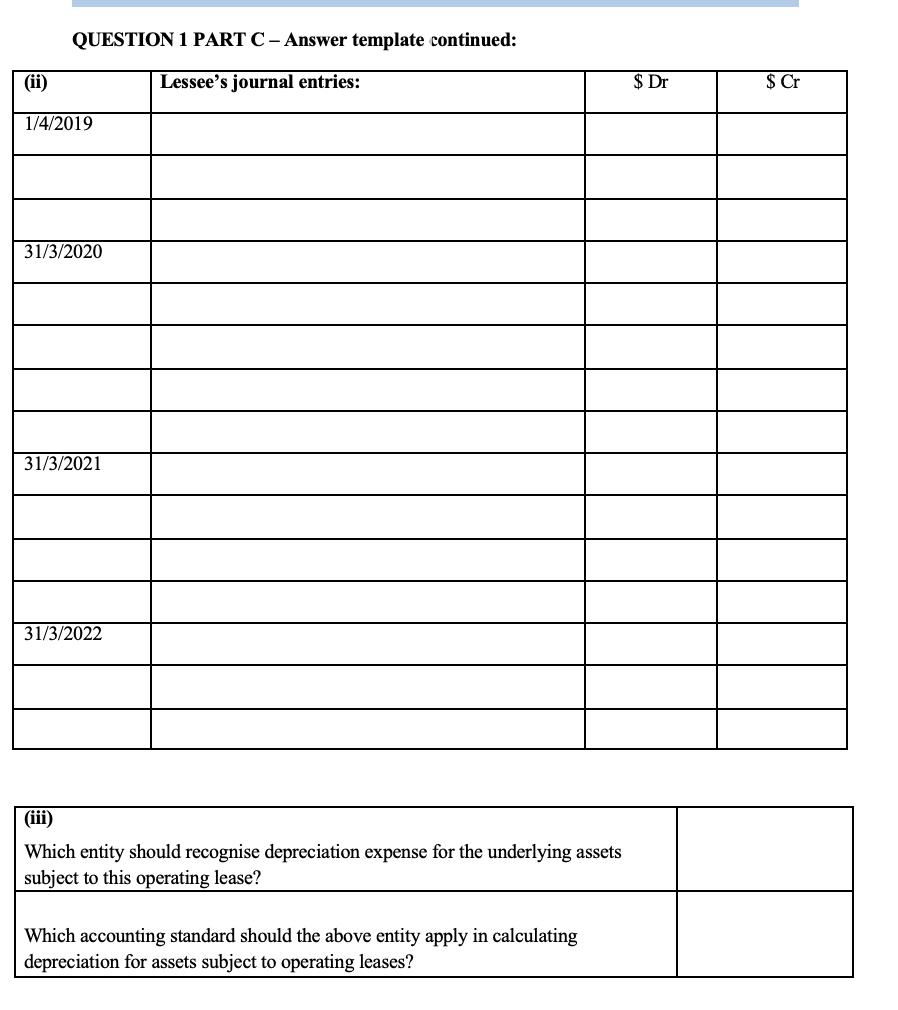

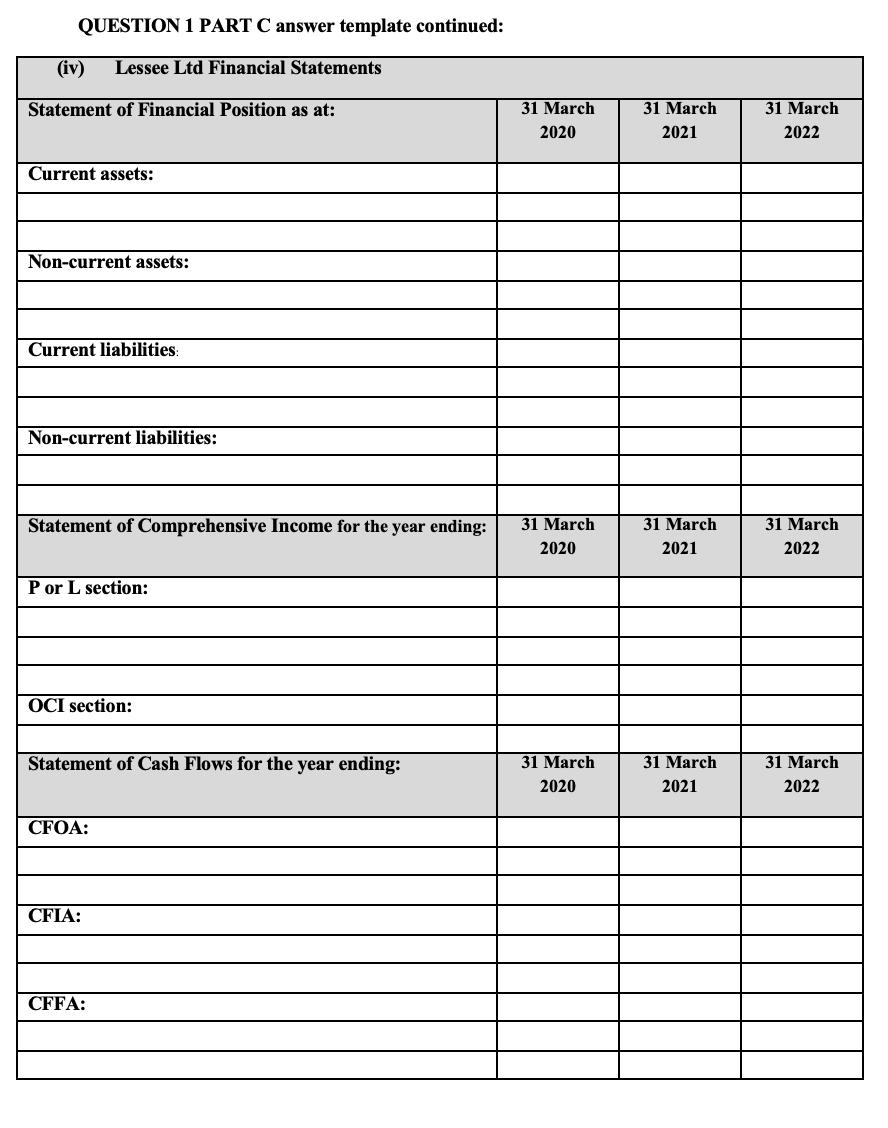

Lessee Ltd (1.e., the lessee) signed a contract with Lessor Ltd (1.e., the lessor) to lease items of office equipment. You are provided with the following lease details: Commencement date Lease term Fixed payments per annum paid at year end Upfront payment due on commencement date Required: 1 April 2019 3 years $6 000 $6 000 (i) Assuming the lease is classified as an operating lease by the lessor, prepare the journal en- tries for Lessor Ltd over the lease term in relation to this lease. (ii) Assuming the lessee takes advantage of the lease exemption allowed for leases with low- value underlying asset under NZ IFRS 16, prepare the journal entries for Lessee Ltd over the lease term in relation to this lease. (iii) Name the entity that should recognise depreciation expense for the office equipment sub- ject to this operating lease. Which accounting standard should this entity apply in calculating depreciation for this leased office equipment? (iv) Prepare financial statements for Lessee Ltd, over the lease period, to reflect the effects of the lease exemption. (i) QUESTION 1 PART C - answer template Lessor's journal entries: 1/4/2019 31/3/2020 31/3/2021 31/3/2022 $ Dr $ Cr (ii) QUESTION 1 PART C - Answer template continued: Lessee's journal entries: 1/4/2019 31/3/2020 31/3/2021 31/3/2022 (iii) Which entity should recognise depreciation expense for the underlying assets subject to this operating lease? Which accounting standard should the above entity apply in calculating depreciation for assets subject to operating leases? $ Dr $ Cr QUESTION 1 PART C answer template continued: (iv) Lessee Ltd Financial Statements Statement of Financial Position as at: Current assets: Non-current assets: Current liabilities: Non-current liabilities: Statement of Comprehensive Income for the year ending: P or L section: OCI section: Statement of Cash Flows for the year ending: CFOA: CFIA: CFFA: 31 March 2020 31 March 2020 31 March 2020 31 March 2021 31 March 2021 31 March 2021 31 March 2022 31 March 2022 31 March 2022 Lessee Ltd (1.e., the lessee) signed a contract with Lessor Ltd (1.e., the lessor) to lease items of office equipment. You are provided with the following lease details: Commencement date Lease term Fixed payments per annum paid at year end Upfront payment due on commencement date Required: 1 April 2019 3 years $6 000 $6 000 (i) Assuming the lease is classified as an operating lease by the lessor, prepare the journal en- tries for Lessor Ltd over the lease term in relation to this lease. (ii) Assuming the lessee takes advantage of the lease exemption allowed for leases with low- value underlying asset under NZ IFRS 16, prepare the journal entries for Lessee Ltd over the lease term in relation to this lease. (iii) Name the entity that should recognise depreciation expense for the office equipment sub- ject to this operating lease. Which accounting standard should this entity apply in calculating depreciation for this leased office equipment? (iv) Prepare financial statements for Lessee Ltd, over the lease period, to reflect the effects of the lease exemption. (i) QUESTION 1 PART C - answer template Lessor's journal entries: 1/4/2019 31/3/2020 31/3/2021 31/3/2022 $ Dr $ Cr (ii) QUESTION 1 PART C - Answer template continued: Lessee's journal entries: 1/4/2019 31/3/2020 31/3/2021 31/3/2022 (iii) Which entity should recognise depreciation expense for the underlying assets subject to this operating lease? Which accounting standard should the above entity apply in calculating depreciation for assets subject to operating leases? $ Dr $ Cr QUESTION 1 PART C answer template continued: (iv) Lessee Ltd Financial Statements Statement of Financial Position as at: Current assets: Non-current assets: Current liabilities: Non-current liabilities: Statement of Comprehensive Income for the year ending: P or L section: OCI section: Statement of Cash Flows for the year ending: CFOA: CFIA: CFFA: 31 March 2020 31 March 2020 31 March 2020 31 March 2021 31 March 2021 31 March 2021 31 March 2022 31 March 2022 31 March 2022 Lessee Ltd (1.e., the lessee) signed a contract with Lessor Ltd (1.e., the lessor) to lease items of office equipment. You are provided with the following lease details: Commencement date Lease term Fixed payments per annum paid at year end Upfront payment due on commencement date Required: 1 April 2019 3 years $6 000 $6 000 (i) Assuming the lease is classified as an operating lease by the lessor, prepare the journal en- tries for Lessor Ltd over the lease term in relation to this lease. (ii) Assuming the lessee takes advantage of the lease exemption allowed for leases with low- value underlying asset under NZ IFRS 16, prepare the journal entries for Lessee Ltd over the lease term in relation to this lease. (iii) Name the entity that should recognise depreciation expense for the office equipment sub- ject to this operating lease. Which accounting standard should this entity apply in calculating depreciation for this leased office equipment? (iv) Prepare financial statements for Lessee Ltd, over the lease period, to reflect the effects of the lease exemption. (i) QUESTION 1 PART C - answer template Lessor's journal entries: 1/4/2019 31/3/2020 31/3/2021 31/3/2022 $ Dr $ Cr (ii) QUESTION 1 PART C - Answer template continued: Lessee's journal entries: 1/4/2019 31/3/2020 31/3/2021 31/3/2022 (iii) Which entity should recognise depreciation expense for the underlying assets subject to this operating lease? Which accounting standard should the above entity apply in calculating depreciation for assets subject to operating leases? $ Dr $ Cr QUESTION 1 PART C answer template continued: (iv) Lessee Ltd Financial Statements Statement of Financial Position as at: Current assets: Non-current assets: Current liabilities: Non-current liabilities: Statement of Comprehensive Income for the year ending: P or L section: OCI section: Statement of Cash Flows for the year ending: CFOA: CFIA: CFFA: 31 March 2020 31 March 2020 31 March 2020 31 March 2021 31 March 2021 31 March 2021 31 March 2022 31 March 2022 31 March 2022

Step by Step Solution

3.49 Rating (176 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts