Question: Let d > 2 be a natural number, and let (92, F, P, T, S) be an arbitrage-free one-period market model with d risky assets

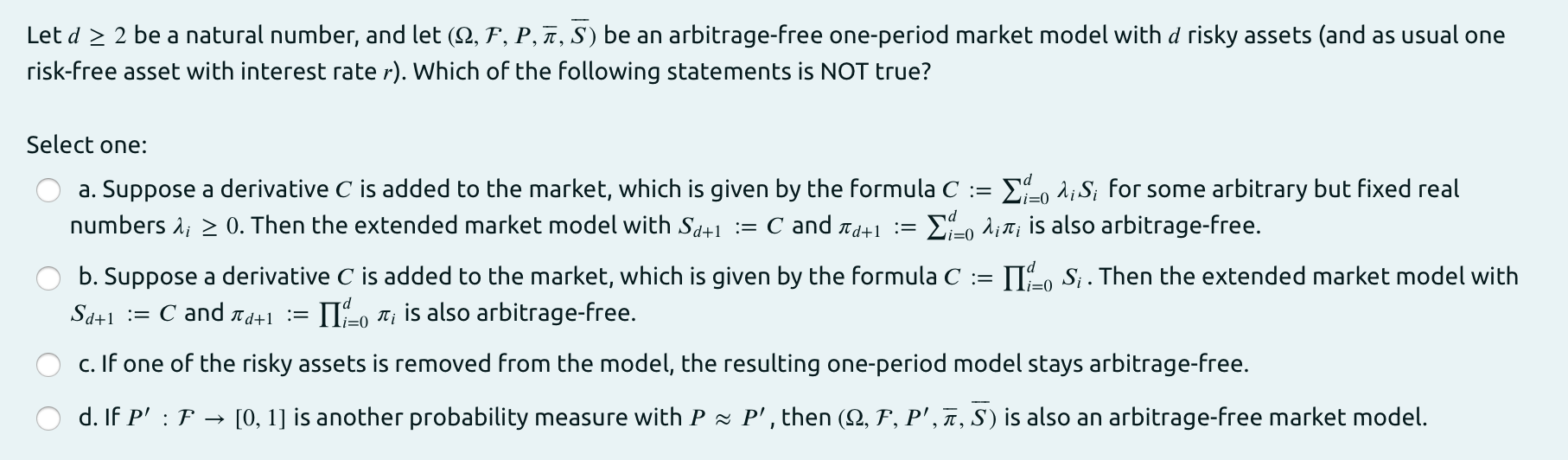

Let d > 2 be a natural number, and let (92, F, P, T, S) be an arbitrage-free one-period market model with d risky assets (and as usual one risk-free asset with interest rate r). Which of the following statements is NOT true? = Select one: a. Suppose a derivative C is added to the market, which is given by the formula C := Li-o diS; for some arbitrary but fixed real numbers li > 0. Then the extended market model with Sd+1 := C and Id+1 Li-o dist; is also arbitrage-free. b. Suppose a derivative C is added to the market, which is given by the formula C := 11-0 S;. Then the extended market model with Sd+1 := C and ad+1 := 11-0 T; is also arbitrage-free. c. If one of the risky assets is removed from the model, the resulting one-period model stays arbitrage-free. d. If P':7 [0, 1] is another probability measure with P = P', then (12, F, P', 1, S) is also an arbitrage-free market model. Let d > 2 be a natural number, and let (92, F, P, T, S) be an arbitrage-free one-period market model with d risky assets (and as usual one risk-free asset with interest rate r). Which of the following statements is NOT true? = Select one: a. Suppose a derivative C is added to the market, which is given by the formula C := Li-o diS; for some arbitrary but fixed real numbers li > 0. Then the extended market model with Sd+1 := C and Id+1 Li-o dist; is also arbitrage-free. b. Suppose a derivative C is added to the market, which is given by the formula C := 11-0 S;. Then the extended market model with Sd+1 := C and ad+1 := 11-0 T; is also arbitrage-free. c. If one of the risky assets is removed from the model, the resulting one-period model stays arbitrage-free. d. If P':7 [0, 1] is another probability measure with P = P', then (12, F, P', 1, S) is also an arbitrage-free market model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts