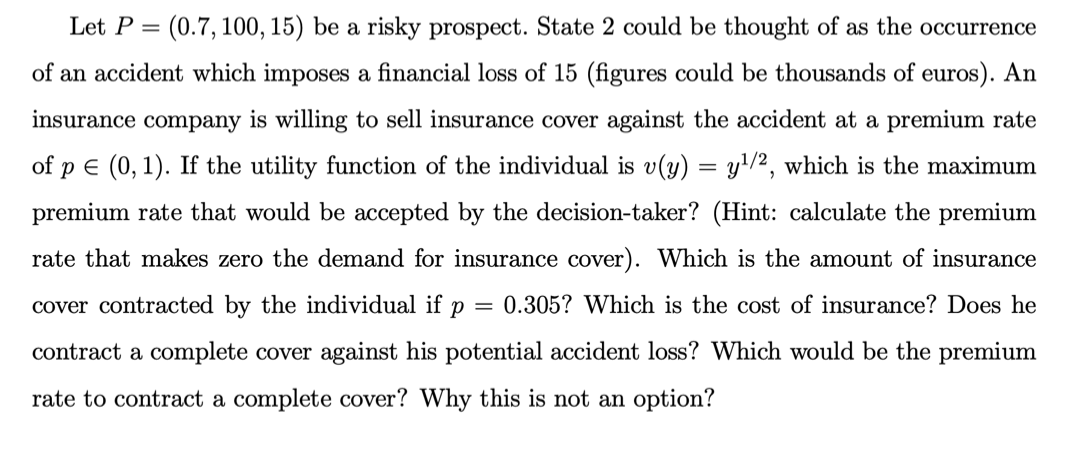

Question: Let P = ( 0 . 7 , 1 0 0 , 1 5 ) be a risky prospect. State 2 could be thought of

Let be a risky prospect. State could be thought of as the occurrence

of an accident which imposes a financial loss of figures could be thousands of euros An

insurance company is willing to sell insurance cover against the accident at a premium rate

of pin If the utility function of the individual is which is the maximum

premium rate that would be accepted by the decisiontaker? Hint: calculate the premium

rate that makes zero the demand for insurance cover Which is the amount of insurance

cover contracted by the individual if Which is the cost of insurance? Does he

contract a complete cover against his potential accident loss? Which would be the premium

rate to contract a complete cover? Why is this is not an option?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock