Question: Let R be a random variable taking three possible values: 7% with probability 0.4, 5% with probability 0.25, -2% with probability 0.35. Consider a 3-year

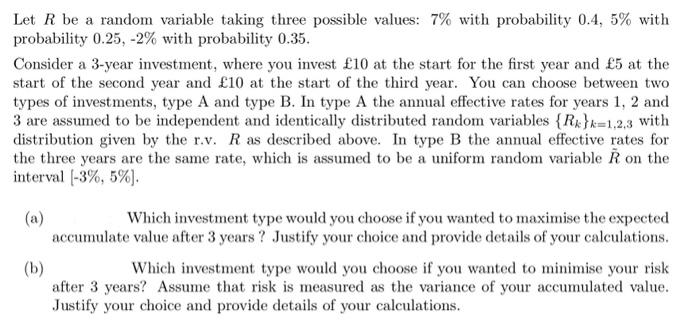

Let R be a random variable taking three possible values: 7% with probability 0.4,5% with probability 0.25,2% with probability 0.35 . Consider a 3-year investment, where you invest 10 at the start for the first year and 5 at the start of the second year and 10 at the start of the third year. You can choose between two types of investments, type A and type B. In type A the annual effective rates for years 1,2 and 3 are assumed to be independent and identically distributed random variables {Rk}k=1,2,3 with distribution given by the r.v. R as described above. In type B the annual effective rates for the three years are the same rate, which is assumed to be a uniform random variable R~ on the interval [3%,5%]. (a) Which investment type would you choose if you wanted to maximise the expected accumulate value after 3 years? Justify your choice and provide details of your calculations. (b) Which investment type would you choose if you wanted to minimise your risk after 3 years? Assume that risk is measured as the variance of your accumulated value. Justify your choice and provide details of your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts