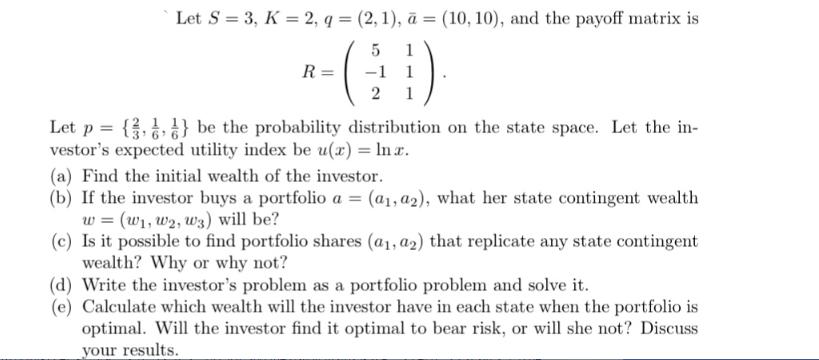

Question: Let S = 3, K = 2, q=(2, 1), = (10, 10), and the payoff matrix is 5 1 1 1 R= -1 2

Let S = 3, K = 2, q=(2, 1), = (10, 10), and the payoff matrix is 5 1 1 1 R= -1 2 Let p = {} be the probability distribution on the state space. Let the in- vestor's expected utility index be u(x) = lnr. (a) Find the initial wealth of the investor. (b) If the investor buys a portfolio a = (a, a2), what her state contingent wealth w = (w, W2, W3) will be? (c) Is it possible to find portfolio shares (a1, a2) that replicate any state contingent wealth? Why or why not? (d) Write the investor's problem as a portfolio problem and solve it. (e) Calculate which wealth will the investor have in each state when the portfolio is optimal. Will the investor find it optimal to bear risk, or will she not? Discuss your results.

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Let S 3 K2 q21 a 1010 and the payof matrix is 5 R Let p be the ... View full answer

Get step-by-step solutions from verified subject matter experts