Question: Let x be a random variable representing annual percent return for the Vanguard Total Stock Index (all Stocks). Let y be a random variable representing

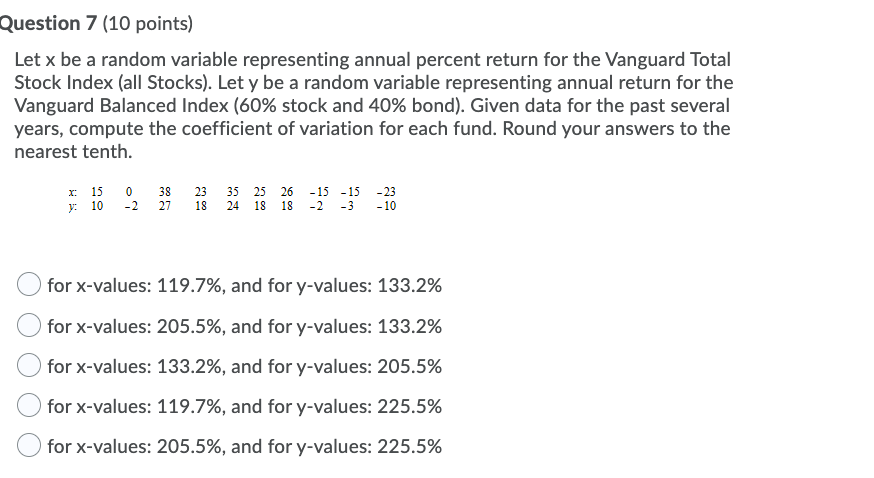

Let x be a random variable representing annual percent return for the Vanguard Total Stock Index (all Stocks). Let y be a random variable representing annual return for the Vanguard Balanced Index (60% stock and 40% bond). Given data for the past several years, compute the coefficient of variation for each fund. Round your answers to the nearest tenth.

Question 7 (10 points) Let x be a random variable representing annual percent return for the Vanguard Total Stock Index (all Stocks}. Let v be a random variable representing annual return for the Vanguard Balanced Index {60% stock and 40% bond}. Given data for the past several years, compute the coefficient of variation for each fund. Round your answers to the nearest tenth. :c: 15 III 35 23 35 25 26 13' 13' 23 y: 10 2 23' IE 24 IE IS 2 3 10 O for xvalues: 119.?%. and for v-values: 133.2% 0 for xvalues: 205.5%. and for v-values: 133.2% 0 for xvalues: 133.2%. and for v-values: 205.5% 0 for xvalues: 119.?%. and for v-values: 225.5% 0 for x-values: 205.5%. and for v-values: 225.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts