Question: Let x be a random variable representing dividend yield of bank stocks. We may assume that x has a normal distribution with o = 3.1%.

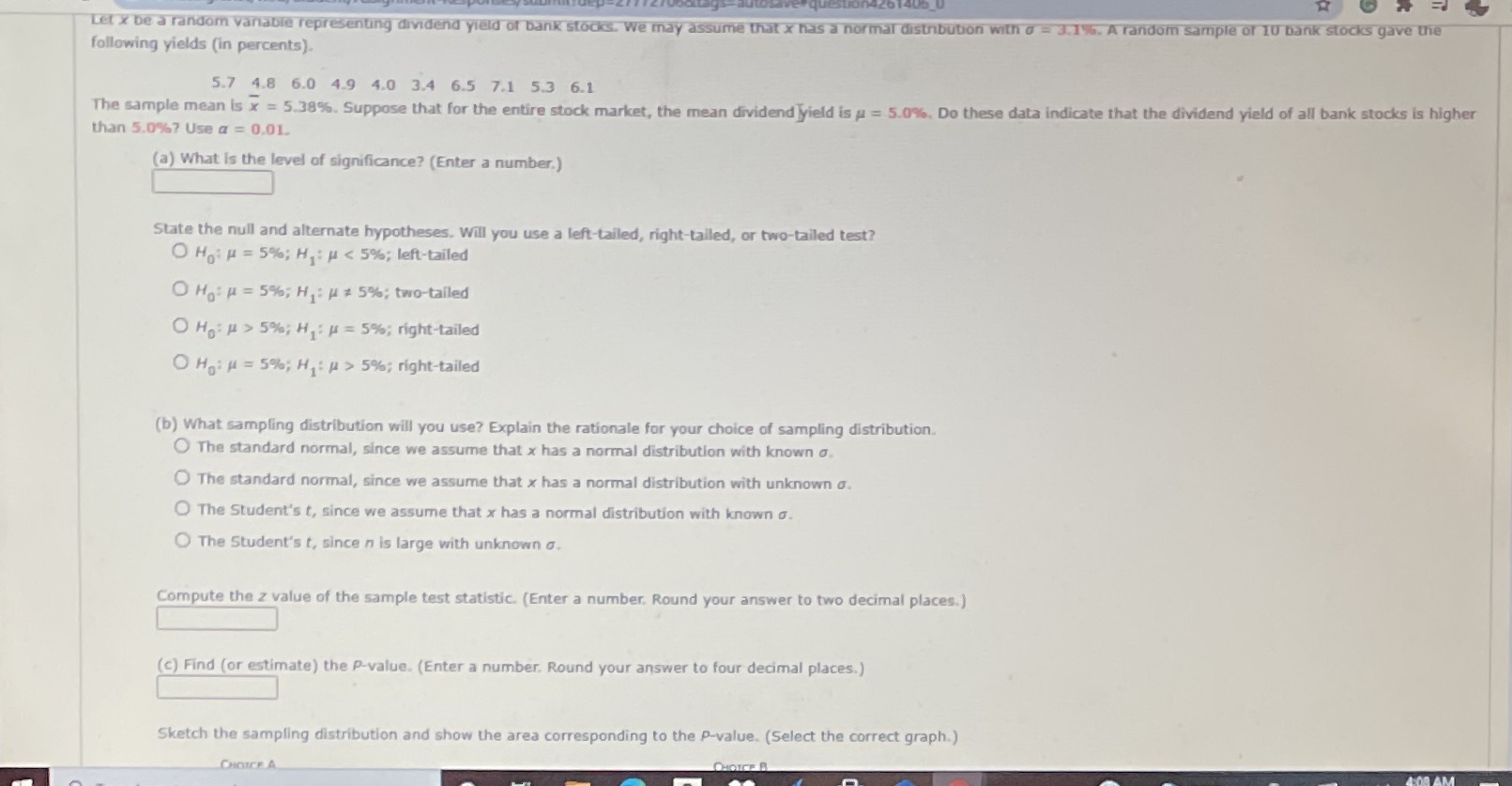

Let x be a random variable representing dividend yield of bank stocks. We may assume that x has a normal distribution with o = 3.1%. A random sample of 10 bank stocks gave the following yields (in percents). 5.7 4.8 6.0 4.9 4.0 3.4 6.5 7.1 5.3 6.1 The sample mean is x = 5.38%. Suppose that for the entire stock market, the mean dividend yield is a = 5.0%, Do these data indicate that the dividend yield of all bank stocks is higher than 5.0%7 Use a = 0.01. (a) What is the level of significance? (Enter a number.) State the null and alternate hypotheses. Will you use a left-tailed, right-tailed, or two-tailed test? O Hail = 5%; H, : H 5%; H1: H = 5%; right-tailed O Hail = 5%; H, : H > 5%; right-tailed (b) What sampling distribution will you use? Explain the rationale for your choice of sampling distribution. O The standard normal, since we assume that x has a normal distribution with known a. The standard normal, since we assume that x has a normal distribution with unknown o. O The Student's t, since we assume that x has a normal distribution with known a. The Student's t, since n is large with unknown a. Compute the z value of the sample test statistic. (Enter a number. Round your answer to two decimal places.) (c) Find (or estimate) the P-value. (Enter a number. Round your answer to four decimal places.) Sketch the sampling distribution and show the area corresponding to the P-value. (Select the correct graph.) CHOICE A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts