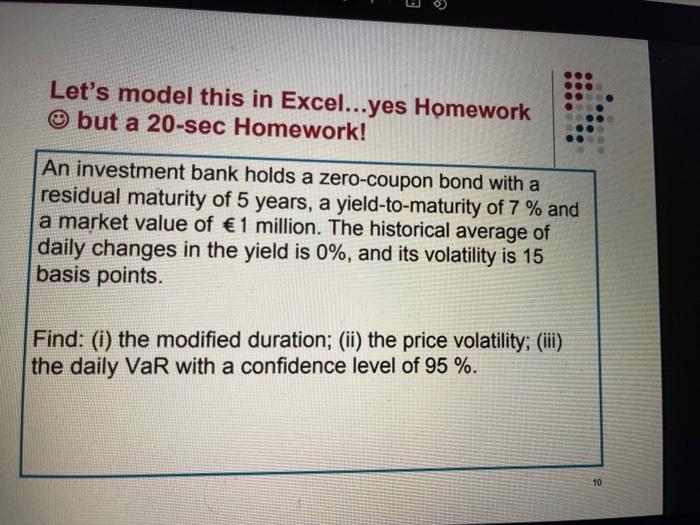

Question: Let's model this in Excel...yes Homework but a 20-sec Homework! An investment bank holds a zero-coupon bond with a residual maturity of 5 years, a

Let's model this in Excel...yes Homework but a 20-sec Homework! An investment bank holds a zero-coupon bond with a residual maturity of 5 years, a yield-to-maturity of 7 % and a market value of 1 million. The historical average of daily changes in the yield is 0%, and its volatility is 15 basis points. Find: (i) the modified duration; (ii) the price volatility; (iii) the daily VaR with a confidence level of 95 %. 10

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock