Question: Let's work out a concrete example of two comparable bonds. The first bond is a zero-coupon bond with a time until maturity of four years.

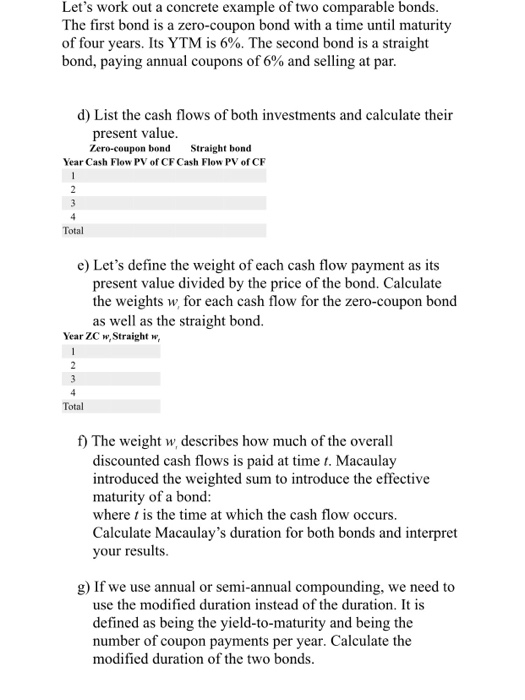

Let's work out a concrete example of two comparable bonds. The first bond is a zero-coupon bond with a time until maturity of four years. Its YTM is 6%. The second bond is a straight bond, paying annual coupons of 6% and selling at par. d) List the cash flows of both investments and calculate their present value. Zero-coupon bond Straight bond Year Cash Flow PV of CF Cash Flow PV of CF Total e) Let's define the weight of each cash flow payment as its present value divided by the price of the bond. Calculate the weights w for each cash flow for the zero-coupon bond as well as the straight bond. Year ZCw, Straight w, Total f) The weight w, describes how much of the overall discounted cash flows is paid at time t. Macaulay introduced the weighted sum to introduce the effective maturity of a bond: where t is the time at which the cash flow occurs. Calculate Macaulay's duration for both bonds and interpret your results. g) If we use annual or semi-annual compounding, we need to use the modified duration instead of the duration. It is defined as being the yield-to-maturity and being the number of coupon payments per year. Calculate the modified duration of the two bonds. Let's work out a concrete example of two comparable bonds. The first bond is a zero-coupon bond with a time until maturity of four years. Its YTM is 6%. The second bond is a straight bond, paying annual coupons of 6% and selling at par. d) List the cash flows of both investments and calculate their present value. Zero-coupon bond Straight bond Year Cash Flow PV of CF Cash Flow PV of CF Total e) Let's define the weight of each cash flow payment as its present value divided by the price of the bond. Calculate the weights w for each cash flow for the zero-coupon bond as well as the straight bond. Year ZCw, Straight w, Total f) The weight w, describes how much of the overall discounted cash flows is paid at time t. Macaulay introduced the weighted sum to introduce the effective maturity of a bond: where t is the time at which the cash flow occurs. Calculate Macaulay's duration for both bonds and interpret your results. g) If we use annual or semi-annual compounding, we need to use the modified duration instead of the duration. It is defined as being the yield-to-maturity and being the number of coupon payments per year. Calculate the modified duration of the two bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts