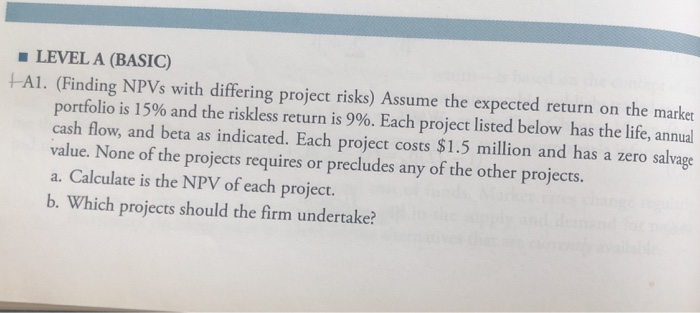

Question: LEVEL A (BASIC) sume the expected return on the market portfolio is 15% and the riskless return is 9%. Each project listed below has the

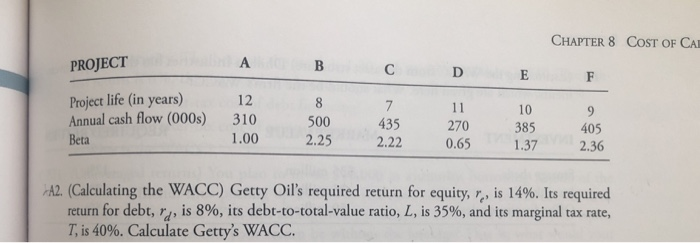

LEVEL A (BASIC) sume the expected return on the market portfolio is 15% and the riskless return is 9%. Each project listed below has the life, annual cash flow, and beta as indicated. Each project costs $1.5 million and has a zero salvage value. None of the projects requires or precludes any of the other projects. a. Calculate is the NPV of each project. b. Which projects should the firm undertake? CHAPTER 8 COST OF CA PROJECT Project life (in years) Annual cash flow (000s) Beta 12 310 1.00 10 500 2.25 435 270 405 2.22 0.65 1.37 2.306 AL (Calculating the WACC) Getty Oil's required return for equity, r,, is 14%. Its required return for debt, a, is 896, its debt-to-total-value ratio, L, is 35%, and its marginal tax rate, T, is 40%. Calculate Getty's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts