Question: please answer question below 1. Papaya Inc. is considering a new project in the fruit distribution business. It has a DIE ratio of 2.5, a

please answer question below

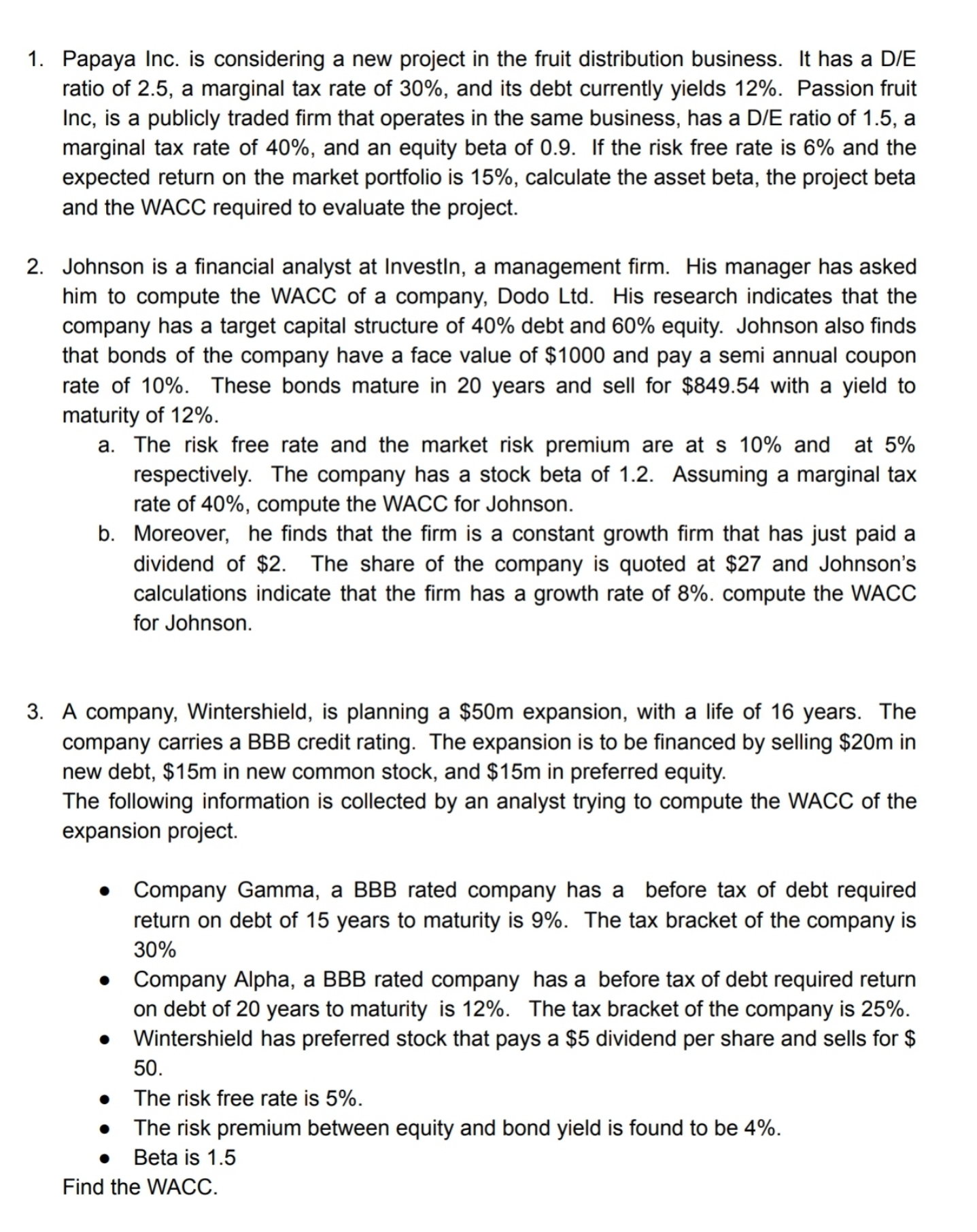

1. Papaya Inc. is considering a new project in the fruit distribution business. It has a DIE ratio of 2.5, a marginal tax rate of 30%, and its debt currently yields 12%. Passion fruit Inc, is a publicly traded rm that operates in the same business, has a DIE ratio of 1.5, a marginal tax rate of 40%, and an equity beta of 0.9. If the risk free rate is 6% and the expected return on the market portfolio is 15%, calculate the asset beta, the project beta and the WACC required to evaluate the project. Johnson is a nancial analyst at Investln, a management rm. His manager has asked him to compute the WACC of a company, Dodo Ltd. His research indicates that the company has a target capital structure of 40% debt and 60% equity. Johnson also nds that bonds of the company have a face value of $1000 and pay a semi annual coupon rate of 10%. These bonds mature in 20 years and sell for $849.54 with a yield to maturity of 12%. a. The risk free rate and the market risk premium are at s 10% and at 5% respectively. The company has a stock beta of 1.2. Assuming a marginal tax rate of 40%. compute the WACC for Johnson. b. Moreover, he nds that the rm is a constant growth rm that has just paid a dividend of $2. The share of the company is quoted at $27 and Johnson's calculations indicate that the rm has a growth rate of 8%. compute the WACC for Johnson. A company, Wintershield, is planning a $50m expansion, with a life of 16 years. The company carries a BBB credit rating. The expansion is to be nanced by selling $20m in new debt, $15m in new common stock, and $15m in preferred equity. The following information is collected by an analyst trying to compute the WACC of the expansion project. 0 Company Gamma. a BBB rated company has a before tax of debt required return on debt of 15 years to maturity is 9%. The tax bracket of the company is 30% a Company Alpha, a BBB rated company has a before tax of debt required return on debt of 20 years to maturity is 12%. The tax bracket of the company is 25%. - Wintershield has preferred stock that pays a $5 dividend per share and sells for $ 50. o The risk free rate is 5%. o The risk premium between equity and bond yield is found to be 4%. a Beta is 1.5 Find the WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts