Question: Levine Company will purchase a van for $40,000. It will have a depreciable life of 5 years and a terminal salvage value of $10,000. Assume

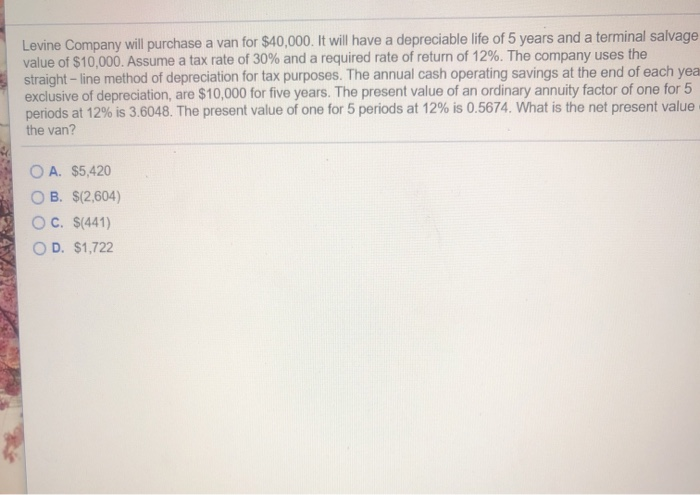

Levine Company will purchase a van for $40,000. It will have a depreciable life of 5 years and a terminal salvage value of $10,000. Assume a tax rate of 30% and a required rate of return of 12%. The company uses the straight - line method of depreciation for tax purposes. The annual cash operating savings at the end of each yea exclusive of depreciation, are $10,000 for five years. The present value of an ordinary annuity factor of one for 5 periods at 12% is 3.6048. The present value of one for 5 periods at 12% is 0.5674. What is the net present value the van? O A. $5,420 OB. $(2,604 OC. $(441) OD. $1,722 The internal rate of return and the net present value methods usually result in the same investment decisions. True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts