Question: please comeplete all steps using cell references following the requirements. Beryl's Iced Tea currently rents a bottling machine for $50,000 per year, including all maintenance

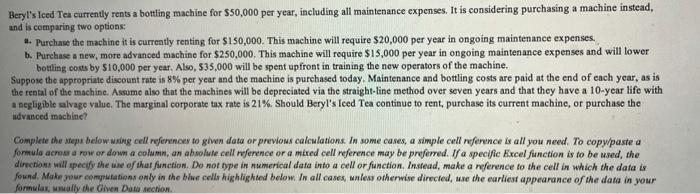

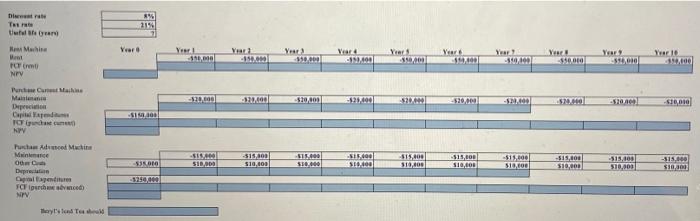

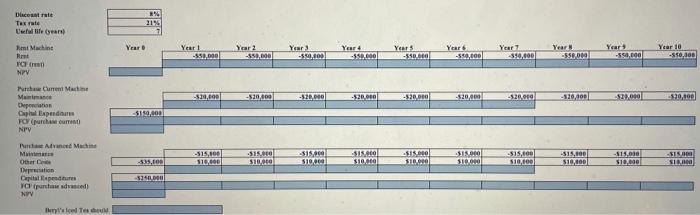

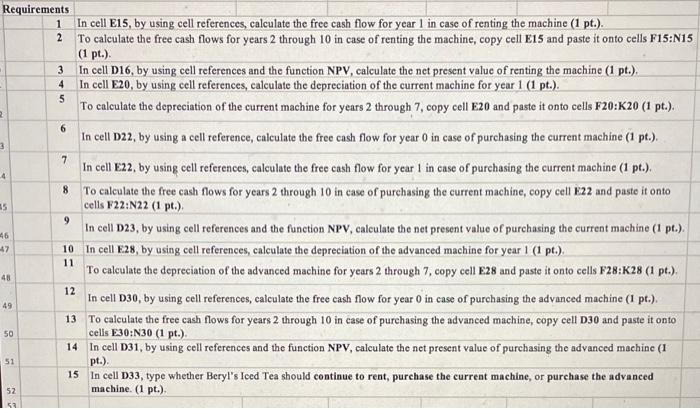

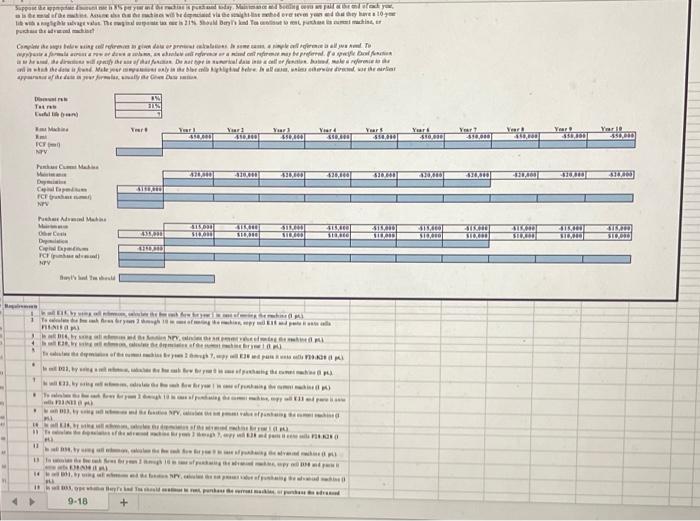

Beryl's Iced Tea currently rents a bottling machine for $50,000 per year, including all maintenance expenses. It is considering purchasing a machine instead, and is comparing two options: # Purchase the machine it is currently renting for $150,000. This machine will require $20,000 per year in ongoing maintenance expenses. b. Purchase a new, more advanced machine for $250,000. This machine will require $15,000 per year in ongoing maintenance expenses and will lower bottling costs by S10,000 per year. Also, 535,000 will be spent upfront in training the new operators of the machine. Suppose the appropriate discount rate is 8% per year and the machine is purchased today. Maintenance and bottling costs are paid at the end of each year, as is the rental of the machine. Assume also that the machines will be depreciated via the straight-line method over seven years and that they have a 10-year life with a negligible salvage value. The marginal corporate tax rate is 21%. Should Beryl's Iced Tea continue to rent, purchase its current machine, or purchase the advanced machine? Complete the steps below ang cell referencer to given data or previous calculations. In some cases, a simple call reference is all you need. To copypaste a formula acrosa row or down a column, an absolute cell reference or a mixed cell reference may be preferred. // a specific Excel function is to be used the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data found. Make your computations only in the blue celle highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formular mually the Chen Date schon a Die TH Uuteen % 21% Year Year Vrati - Year 350.000 Yeart Machine Want PC NEV Year Year Yee 53000 Year -5940 Year 10 100 120.000 -$10,000 121,400 an -10,00 PCM Man Capital and TO MPY 14100 -18.00 510.000 -515,000 510.000 S5400 5.400 SOLO 590.000 -$15,400 310,000 -$15,000 $10,00 -515,000 1000 -515,000 $10.00 -513,100 510.000 -315.000 510,30 Puchatel Mwine Maine othidam De penditure NEV -5259,90 Tery's DO Tax rate Uw life and AG 21% i Mwins Year Year 550.000 Year 2 Year 4 -550.000 -590.000 -$50.00 Year -590.000 Year -550 000 Year 10 -550,00 Year -550,000 -550.000 CH MN -310,000 -$20,00 -520.000 -$20,000 -320.00 -$20,000 -520019 $20.000 boots the Current Machine Mamma Chepation Ophal Expendur Form NPV 149,00 Advanced Machine M -SIS -515,00 110.40 -515 0.29 315.000 510,000 SIMO $10.00 S$ 000 $10.00 $15.00 510.000 -315.00 $10,00 -515. -515,00 $10.0001 -$15.00 $10,000 Doris Our Depuration Capital Espendare Yoursed MPV 3250.000 teles 2 3 4 5 2 6 3 7 4 8 Requirements 1 In cell E15, by using cell references, calculate the free cash flow for year 1 in case of renting the machine (1 pt.). To calculate the free cash flows for years 2 through 10 in case of renting the machine, copy cell E15 and paste it onto cells F15:N15 (1 pt.). In cell D16, by using cell references and the function NPV, calculate the net present value of renting the machine (1 pt.). In cell E20, by using cell references, calculate the depreciation of the current machine for year 1 (1 pt.). To calculate the depreciation of the current machine for years 2 through 7, copy cell E20 and paste it onto cells F20:K20 (1 pt.). In cell D22, by using a cell reference, calculate the free cash flow for year 0 in case of purchasing the current machine (1 pt.). In cell E22, by using cell references, calculate the free cash flow for year I in case of purchasing the current machine (1 pt.). To calculate the free cash flows for years 2 through 10 in case of purchasing the current machine, copy cell E22 and paste it onto cells F22:N22 (1 pt.) In cell D23, by using cell references and the function NPV, calculate the net present value of purchasing the current machine (1 pt.). In cell E28, by using cell references, calculate the depreciation of the advanced machine for year 1 (1 pt.). To calculate the depreciation of the advanced machine for years 2 through 7, copy cell E28 and paste it onto cells F28:K28 (1 pt.) In cell D30, by using cell references, calculate the free cash flow for year 0 in case of purchasing the advanced machine (I pt.). 13 To calculate the free cash flows for years 2 through 10 in case of purchasing the advanced machine, copy cell D30 and paste it onto cells E30:N30 (1 pt.) 14 In cell D31, by using cell references and the function NPV, calculate the net present value of purchasing the advanced machine (1 pt.) 15 In cell D33, type whether Beryl's Iced Tea should continue to rent, purchase the current machine, or purchase the advanced machine. (1 pt.) 35 9 46 87 10 11 48 12 49 50 51 52 52 Sarpa y Medip , la e Mahal tea Facia-tart rate it rrarirarkar NE Tar tam Maha| Ital INV hutu un Var VAL HO Ya 327380 11 Var -35 BRE 550,00 THIS ( Set IFE terest INNI Tata Naal Make CREATE DIS 11 HIS CE HIN TET STIL ST Dipala | Iran) NPY tamiltal tuit www To PALLAH 1 WO , . 1 #to nAIR .. A) 1 DER 11 10 - Thema 9-18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts