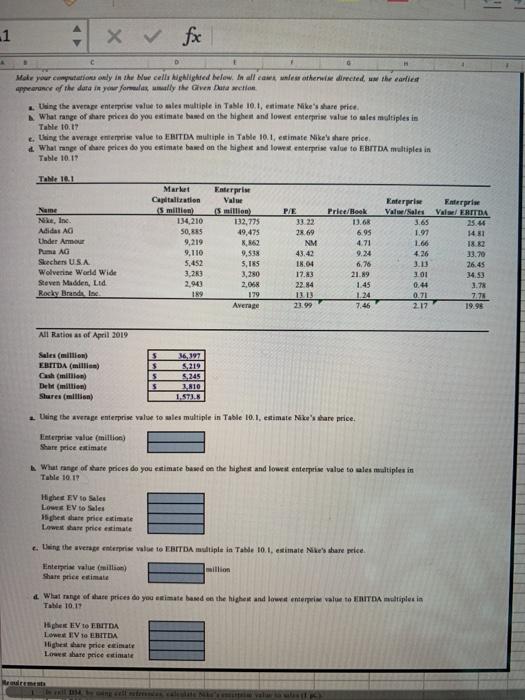

Question: li 1 x & fox Make your computation only in the New cells Highlighted below. In all cate otherwise directed the earliest appearance of the

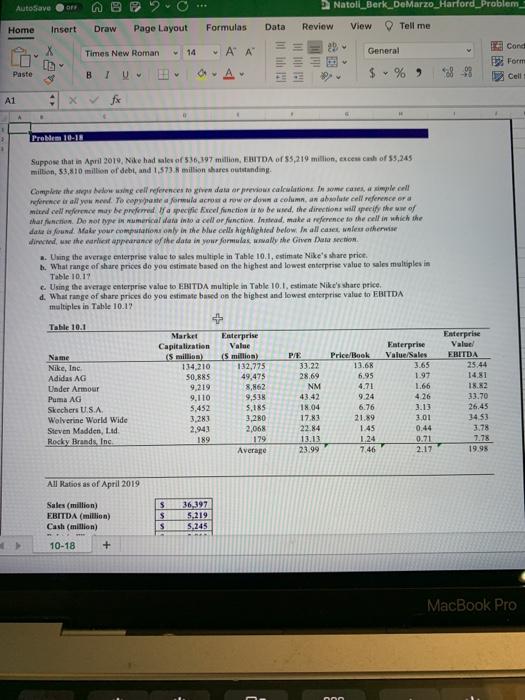

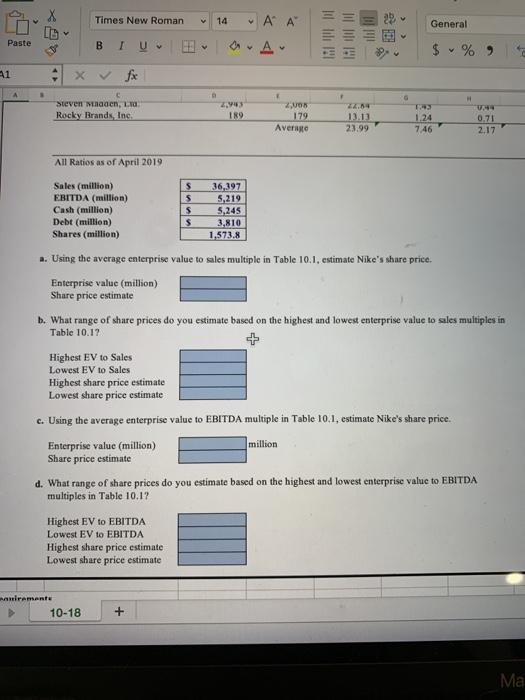

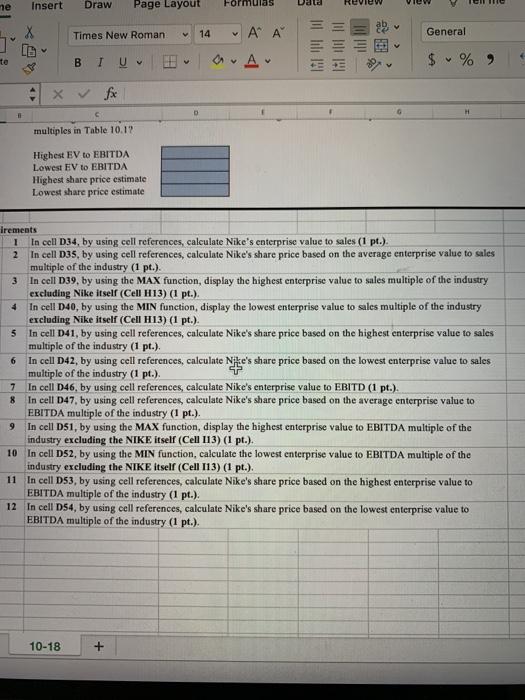

li 1 x & fox Make your computation only in the New cells Highlighted below. In all cate otherwise directed the earliest appearance of the data is your former mally the Gwen Duration Uiing the awape enterprise value to ales multiple in Table 10.1, estimate Nike's share price What range of share pice do you estimate bused on the highest and lowest enterprise value to ales multiples in Table 10.17 thing the average enterprise value to EBITDA multiple in Table 10.1, estimate Nike's share price 4 What mnge of share prices do you estimate based on the highest and low enterprise value to EBITDA multiples in Table 10.12 TaN 100 Name Ne, Inc Adidas AG Under Armour Pane AG Skechers USA Wolverine World Wide Steve Madden, Ltd Rocky Brands, Inc Market Capitalization (5 million 134,210 50.885 9,219 9.110 5,452 3.263 2,90 Enterprise Vale (5 million 132,775 19,475 K,862 9,538 SIRS 3.280 2.05 179 Average PE 3322 28. 69 NM 43.42 18.04 17.83 22.84 Priet/Book 13.68 6.95 4.71 9.24 6,76 21.89 1.45 1.24 7.46 Enterpri Val Sales 3.65 1.97 166 426 J.13 101 0.41 0.71 2:17 Enterprise VERITDA 25.4 1481 18.82 33.70 26.45 34.53 1.78 7.75 19.95 23.99 All Ratiosss of April 2019 Sales (million) EBITDA (million) as (mltilan) Delirt (million) Shures (million) $ S 5 s 16,397 5219 5,245 3.810 1.STI. Using the average enterprise value to les multiple in Table 10.1, estimate Nike's share price. Enterprise value (million) Share price estimate What range of share prices do you estimate based on the highest and lowed enterprise value to wles multiples in Table 10.19 Higher EV to Sales Low EV to Sales 15 dure price estimate Low price estimate in the serpenterprise to EBITDA multiple in Table 101, estimate Nike share le Enterprise value million million Share price citimate What runs or are prices de you atimate and on the higher and low enterprivalue to HITDA multiples in I EV EBITDA Low IV 1 EBITDA Higher price imate Lo share price estimate li 1 x & fox Make your computation only in the New cells Highlighted below. In all cate otherwise directed the earliest appearance of the data is your former mally the Gwen Duration Uiing the awape enterprise value to ales multiple in Table 10.1, estimate Nike's share price What range of share pice do you estimate bused on the highest and lowest enterprise value to ales multiples in Table 10.17 thing the average enterprise value to EBITDA multiple in Table 10.1, estimate Nike's share price 4 What mnge of share prices do you estimate based on the highest and low enterprise value to EBITDA multiples in Table 10.12 TaN 100 Name Ne, Inc Adidas AG Under Armour Pane AG Skechers USA Wolverine World Wide Steve Madden, Ltd Rocky Brands, Inc Market Capitalization (5 million 134,210 50.885 9,219 9.110 5,452 3.263 2,90 Enterprise Vale (5 million 132,775 19,475 K,862 9,538 SIRS 3.280 2.05 179 Average PE 3322 28. 69 NM 43.42 18.04 17.83 22.84 Priet/Book 13.68 6.95 4.71 9.24 6,76 21.89 1.45 1.24 7.46 Enterpri Val Sales 3.65 1.97 166 426 J.13 101 0.41 0.71 2:17 Enterprise VERITDA 25.4 1481 18.82 33.70 26.45 34.53 1.78 7.75 19.95 23.99 All Ratiosss of April 2019 Sales (million) EBITDA (million) as (mltilan) Delirt (million) Shures (million) $ S 5 s 16,397 5219 5,245 3.810 1.STI. Using the average enterprise value to les multiple in Table 10.1, estimate Nike's share price. Enterprise value (million) Share price estimate What range of share prices do you estimate based on the highest and lowed enterprise value to wles multiples in Table 10.19 Higher EV to Sales Low EV to Sales 15 dure price estimate Low price estimate in the serpenterprise to EBITDA multiple in Table 101, estimate Nike share le Enterprise value million million Share price citimate What runs or are prices de you atimate and on the higher and low enterprivalue to HITDA multiples in I EV EBITDA Low IV 1 EBITDA Higher price imate Lo share price estimate AutoSave Natoll_Berk DeMarzo_Harford_Problem, o Page Layout Home Insert Draw Formulas Data Review View Tell me 29 Times New Roman 14 ' ' Illlili General La Cond Form Cell Paste B 1 U A $ % A1 x fx 2 Problem 10-12 Suppose that in April 2019, Nike had sale of 536,197 million, EBITDA of 55,219 million, ce cash of 53,245 million, 53,810 million of debt, and 1.573.8 million shares outstanding Complete the wing cell references to give den or previous calculationsIn some cases, simple cell e all you need to capra a formulacrosa row or down a column, an absolute cell reference or a med cell reference may be preferred a specifice Excel function is to be wed, the directions will get the wwe of har funnen. De morbi numerical data into a call or function. Instead, make a reference to the cell in which the date found. Make your computation only in the Wue cells highlighted below. In all case unless otherwise w the earliest appearance of the date in your formules, wally the Gwen Datation a. Uning the average enterprise value to sales multiple in Table 10.1, estimate Nike's share price . What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in Table 10.17 e. Using the average enterprise value to EESTDA multiple in Table 10.1, estimate Nike's share price d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in Table 10.17 Table 10.1 Name Nike, Inc Adidas AG Under Armour Puma AG Skechers U.S.A Wolverine World Wide Steve Madden, Lid Rocky Brands Inc Market Capitalization (5 million) 134 210 50885 9.219 9.110 5,452 3.283 Enterprise Value (5 million) 132,775 49,475 8,862 9,538 5,185 3,280 2,068 179 Average PE 33.22 28.69 NM 43.42 18.04 1783 22.84 13.13 23.99 Price/Book 13.6 6.95 4.71 9.24 6.76 21.89 1.45 1.24 7.46 Enterprise Value/Sales 3.65 1.97 1.66 4.26 3.13 3.01 0.44 0.71 2.17 Enterprise Value EBITDA 25.44 1481 18.82 33.70 26.45 1453 3.78 7.78 19.95 2.943 189 All Ratios as of April 2019 Sales (million) EBITDA (million) Cash (million) 10-18 + $ $ $ 36,397 5,219 5.245 MacBook Pro ne Insert Draw Page Layout Formulas Times New Roman 14 General te BIU a Av $ %) multiples in Table 10.1? Highest EV to EBITDA Lowest EV to EBITDA Highest share price estimate Lowest share price estimate irements 6 In cell D34, by using cell references, calculate Nike's enterprise value to sales (1 pt.). 2 In cell DJs, by using cell references, calculate Nike's share price based on the average enterprise value to sales multiple of the industry (1 pt.). 3 In cell D39, by using the MAX function, display the highest enterprise value to sales multiple of the industry excluding Nike itself (Cell H13) (1 pt.). * In cell D40, by using the MIN function, display the lowest enterprise value to sales multiple of the industry excluding Nike itself (Cell H13) (1 pt.). 5 In cell D41, by using cell references, calculate Nike's share price based on the highest enterprise value to sales multiple of the industry (1 pt.). In cell D42, by using cell references, calculate Nine's share price based on the lowest enterprise value to sales multiple of the industry (1 pt.). In cell D46, by using cell references, calculate Nike's enterprise value to EBITD (1 pt.). In cell D47, by using cell references, calculate Nike's share price based on the average enterprise value to EBITDA multiple of the industry (I pt.). 9 In cell D51, by using the MAX function, display the highest enterprise value to EBITDA multiple of the industry excluding the NIKE itself (Cell 113) (1 pt.). 10 In cell D52, by using the MIN function, calculate the lowest enterprise value to EBITDA multiple of the industry excluding the NIKE itself (Cell 113) (1 pt.). 11 In cell D53, by using cell references, calculate Nike's share price based on the highest enterprise value to EBITDA multiple of the industry (1 pt.). 12 In cell DS4, by using cell references, calculate Nike's share price based on the lowest enterprise value to EBITDA multiple of the industry (I pt.). 7 8 10-18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts