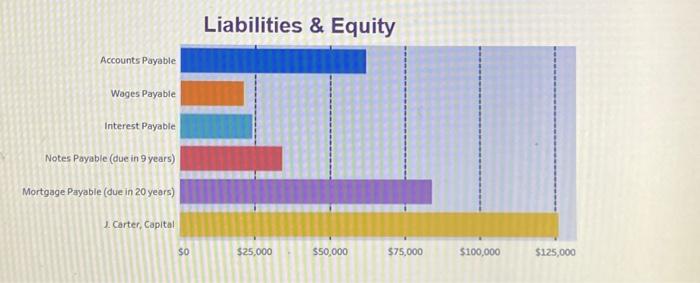

Question: Liabilities & Equity Accounts Payable Wages Payable Interest Payable Notes Payable (due in 9 years) Mortgage Payable (due in 20 years) 1. Carter, Capital 1.

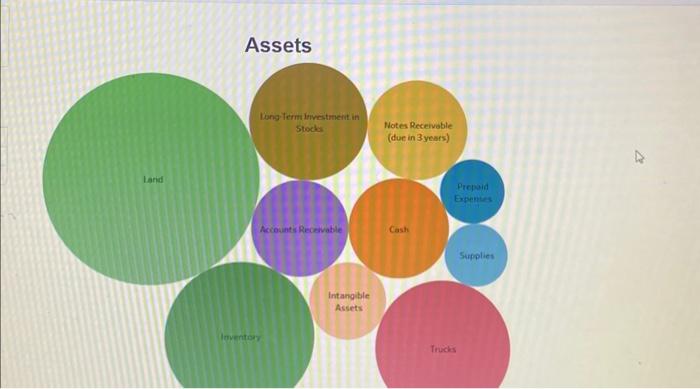

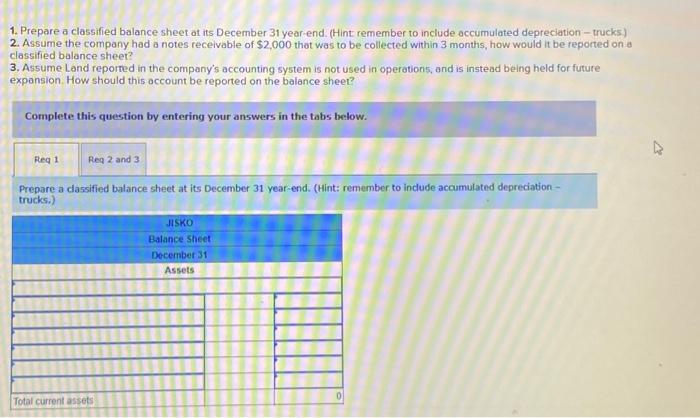

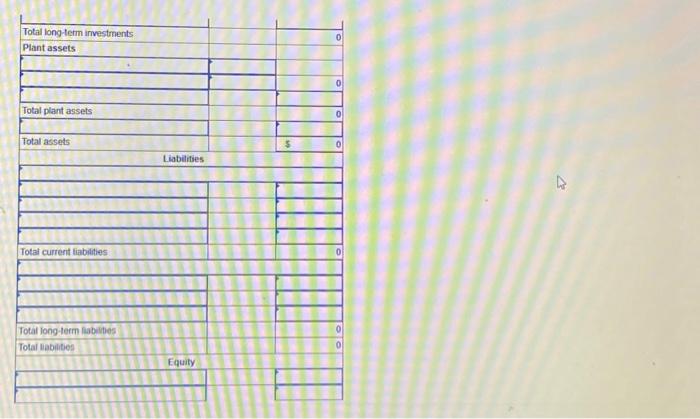

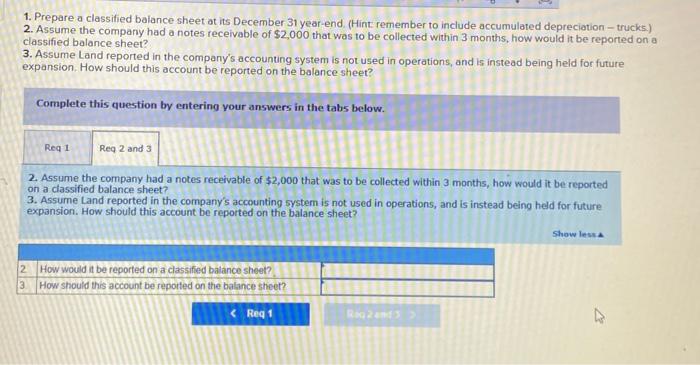

Liabilities \& Equity Accounts Payable Wages Payable Interest Payable Notes Payable (due in 9 years) Mortgage Payable (due in 20 years) 1. Carter, Capital 1. Prepare a classified balance sheet at its December 31 year-end. (Hint remember to include accumulated depreciation - trucks.) 2. Assume the company had a notes receivable of $2,000 that was to be collected within 3 months, how would it be reported on a classified bolance sheet? 3. Assume Land reported in the company's accounting system is not used in operations, and is instead being held for future expansion. How should this account be reported on the balance sheet? Complete this question by entering your answers in the tabs below. Req 2 and 3 2. Assume the company had a notes receivable of $2,000 that was to be collected within 3 months, how would it be reported on a classified balance sheet? 3. Assume Land reported in the company's accounting system is not used in operations, and is instead being held for future expansion. How should this account be reported on the balance sheet? \begin{tabular}{|l|l|} \hline 2 & How would it be reported on a classified balance sheet? \\ \hline 3 & How should this account be reported on the balance sheet? \\ \hline \end{tabular} Show lens Tableau DA 4-3: Mini-Case, Preparing a classified balance sheet LO5 The CEO of Jisko requests our help in preparing year-end financial reports. The CEO explains that they are having difficulty classifying accounts. The Tableau dashboard shows December 31 year-end data from the company's accounting system. 1. Prepare a classified balance sheet at its December 31 year-end. (Hint remember to include accumulated depreciation-trucks) 2. Assume the company had a notes receivable of $2,000 thot was to be collected within 3 months, how would it be reported on a classified balance sheer? 3. Assume Land reported in the company's accounting system is not used in operations, and is instead being held for future expansion. How should this occount be reported on the balance sheet? Complete this question by entering your answers in the tabs below. Prepare a dassified balance sheet at its December 31 year-end. (Hint: remember to indude accumulated depreciation-trucks.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts