Question: LIBOR HW. Need help. Ty Companies A and B have been offered the following rates per annum on a $20 million 5-year loan and a

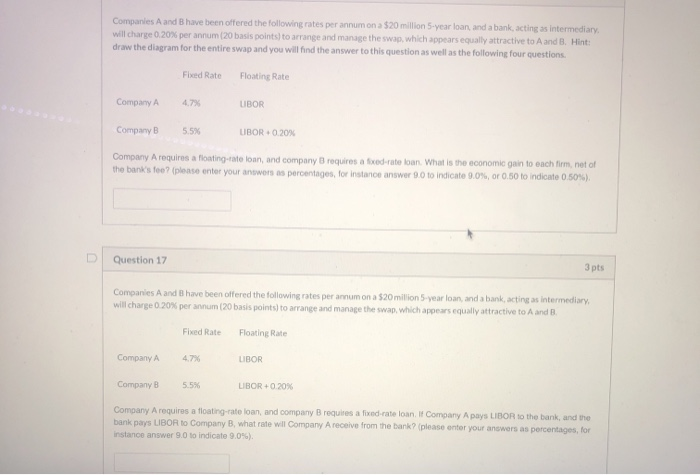

Companies A and B have been offered the following rates per annum on a $20 million 5-year loan and a bank, acting as intermediary. will change 0.20% per annum 120 basis points to arrange and manage the swap, which appears equally attractive to A and B. Hint: draw the diagram for the entire swap and you will find the answer to this question as well as the following four questions. Fixed Rate Floating Rate Company A 4.7% LIBOR Company B 5.5% UBOR +0.20% Company A requires a floating-rate loan, and company requires a fixed-rate loan What is the economic gain to each firm net of the bank's fee? (please enter your answers as percentages, for instance answer 9.0 to indicate 9.0%, or 0.50 to indicate 0.50%). Question 17 3 pts Companies A and B have been offered the following rates per annum on a $20 million 5-year loan and a bank acting as intermediary will change 0.20% per annum (20 basis points) to arrange and manage the swap, which appears equally attractive to A and B. Fixed Rate Floating Rate Company A 4.7% LIBOR Company B 5.5% LIBOR +0,20% Company A requires a floating-rate loan, and company requires a fixed-rate loan. If Company Apays LIBOR to the bank, and the bank pays UBOR to Company B what rate will Company A receive from the bark? please enter your answers as percentages, for instance answer 9.0 to indicate 9.0%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts