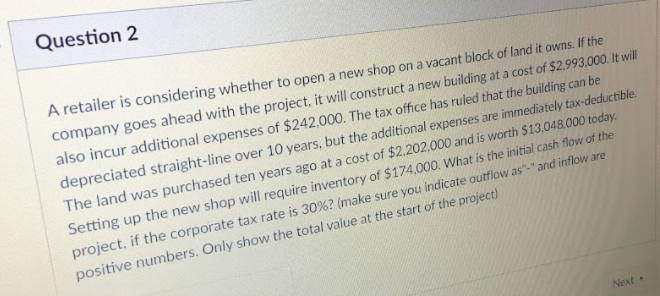

Question: Question 2 A retailer is considering whether to open a new shop on a vacant block of land it owns. If the company goes ahead

Question 2 A retailer is considering whether to open a new shop on a vacant block of land it owns. If the company goes ahead with the project, it will construct a new building at a cost of $2,993,000. It will also incur additional expenses of $242,000. The tax office has ruled that the building can be depreciated straight-line over 10 years, but the additional expenses are immediately tax deductible The land was purchased ten years ago at a cost of $2.202.000 and is worth $13,048.000 today. Setting up the new shop will require inventory of $174,000. What is the initial cash flow of the project, if the corporate tax rate is 30%? (make sure you indicate outflow as - and inflow are positive numbers. Only show the total value at the start of the project) Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts