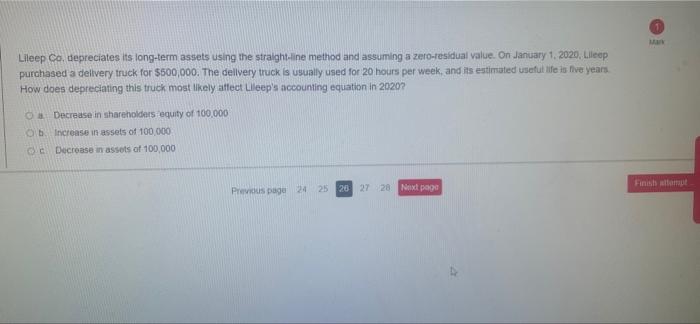

Question: Lileep Co. depreciates its long-term assets using the straight-line method and assuming a zero-residual value. On January 1, 2020, Lileep purchased a delivery truck for

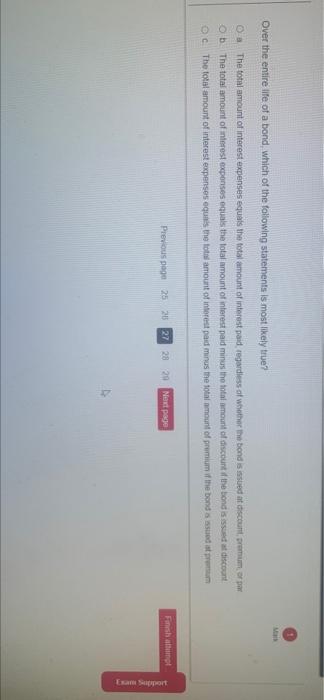

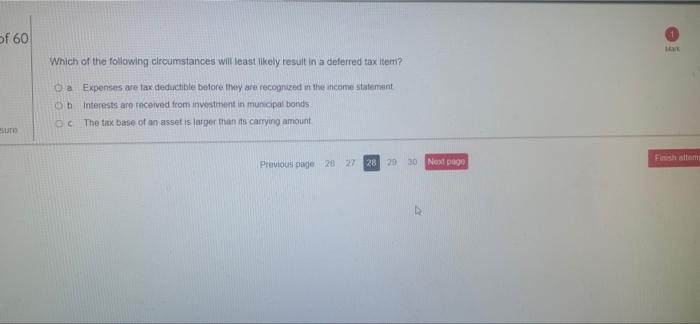

Lileep Co. depreciates its long-term assets using the straight-line method and assuming a zero-residual value. On January 1, 2020, Lileep purchased a delivery truck for $500,000. The delivery truck is usually used for 20 hours per week, and its estimated useful life is live years How does depreciating this truck most likely atteet Lileep's accounting equation in 20207 O Decrease in shareholders equity of 100.000 ob Increase in assets of 100 000 e Decrease in assets of 100,000 Finis stom Previous page 24 25 26 27 28 Next page Over the entire life of a bond, which of the following statements is most likely true? - The total amount of interest expenses equals the total amount of interest paid regardless of whether the bond is issued at contremum Ob The total amount of interest expenses quals the total amount of interest paid minus the total amount of discount of the bond is issued a discount oc The total amount of interest expenses equals the total amount of interest paid minus the total amount of premium if the bond assistan Previous page 25 26 27 28 29 Next page Fish ESport of 60 an Which of the following circumstances will least likely result in a deferred tax item? Da Expenses are tax deductible before they are recognized in the income statement Ob Interests are received from investment in municipal bonds OCThe tax base of an asset is larger than its carrying amount Sur Finish allem Previous page 26 27 28 29 30 Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts