Question: Lind 8 Assignment 3 - Fall 2020 - WACC - Protected View - Saved to this PC- ign Layout References Mailings Review View Help the

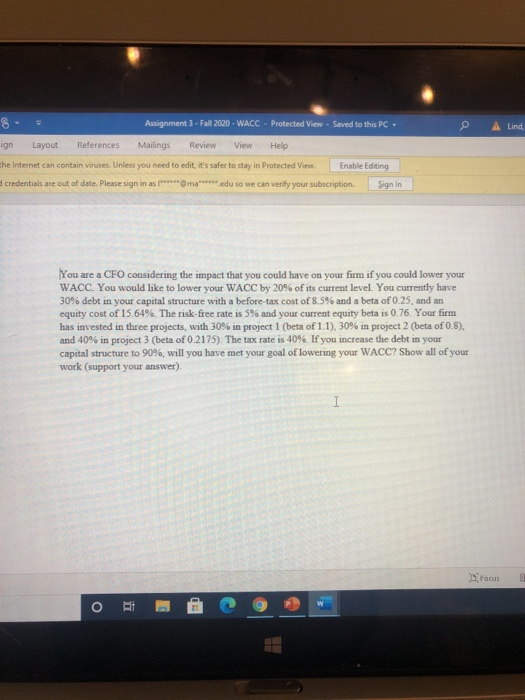

Lind 8 Assignment 3 - Fall 2020 - WACC - Protected View - Saved to this PC- ign Layout References Mailings Review View Help the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing credentials are out of date. Please sign in as *****Oma *****edu so we can verify your subscription Sign In You are a CFO considering the impact that you could have on your firm if you could lower your WACC. You would like to lower your WACC by 20% of its current level. You currently have 30% debt in your capital structure with a before-tax cost of 8.5% and a beta of 0.25, and an equity cost of 15.64%. The risk-free rate is 5% and your current equity beta is 0.76. Your firm has invested in three projects, with 30% in project 1 (beta of 1.1). 30% in project 2 (beta of 0.8). and 40% in project 3 (beta of 0.2175). The tax rate is 40%. If you increase the debt in your capital structure to 90%, will you have met your goal of lowering your WACC? Show all of your work (support your answer) Focus O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts