Question: Link https://www.doughroller.net/taxes/federal-income-tax-brackets-deductions-and-exemption-limits/ Tax.java /* Programmer: Date: Project: Lab 2.4 Tax File Name: Tax.java Program Description: Determines the taxes a person owes */ import java.util.*; public

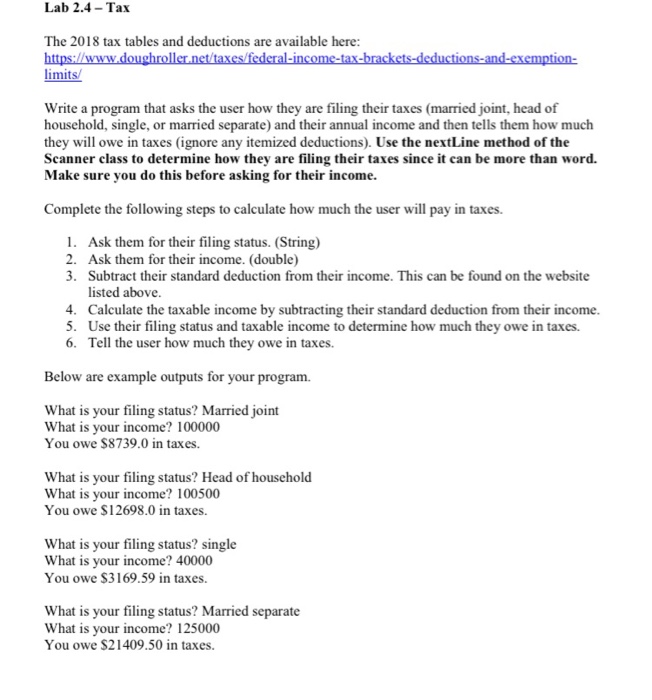

Lab 2.4 Tax The 2018 tax tables and deductions are available here: mits Write a program that asks the user how they are filing their taxes (married joint, head of household, single, or married separate) and their annual income and then tells them how much they will owe in taxes (ignore any itemized deductions). Use the nextLine method of the Scanner class to determine how they are filing their taxes since it can be more than word. Make sure you do this before asking for their income. Complete the following steps to calculate how much the user will pay in taxes. 1. Ask them for their filing status. (String) 2. Ask them for their income. (double) 3. Subtract their standard deduction from their income. This can be found on the website listed above 4. Calculate the taxable income by subtracting their standard deduction from their income 5. Use their filing status and taxable income to determine how much they owe in taxes. 6. Tell the user how much they owe in taxes. Below are example outputs for your program. What is your filing status? Married joint What is your income? 100000 You owe $8739.0 in taxes. What is your filing status? Head of household is your income? 100500 You owe $12698.0 in taxes. What is your filing status? single What is your income? 40000 You owe $3169.59 in taxes. What is your filing status? Married What is You owe $21409.50 in taxes. separate your income? 125000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts