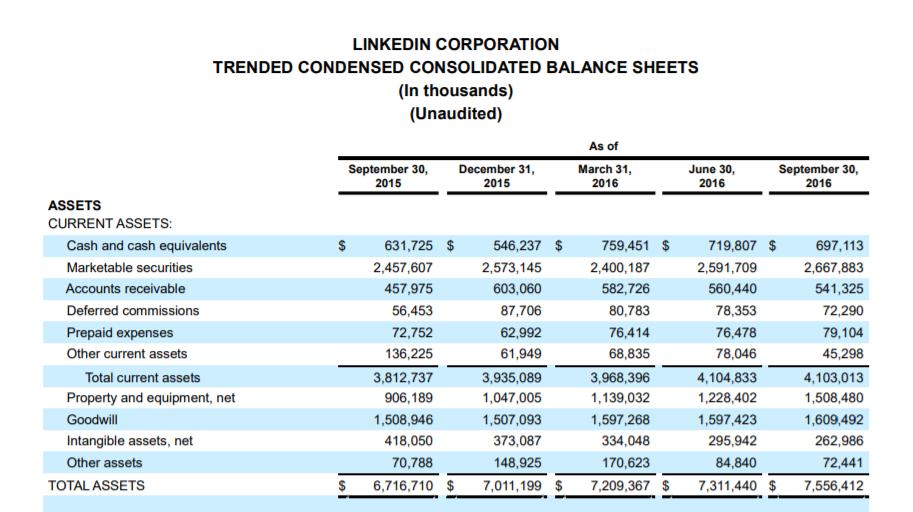

Question: LinkedIn's September 30, 2016, Form 10-Q balance sheet data reported certain items very differently from the way that Microsoft allocated its purchase price to LinkedIn's

LinkedIn's September 30, 2016, Form 10-Q balance sheet data reported certain items very differently from the way that Microsoft allocated its purchase price to LinkedIn's assets and liabilities as of December 6, 2016.

Compare intangible assets, as reported as of September 30 and December 6. What is the difference in amount, and why do you think this occurred?

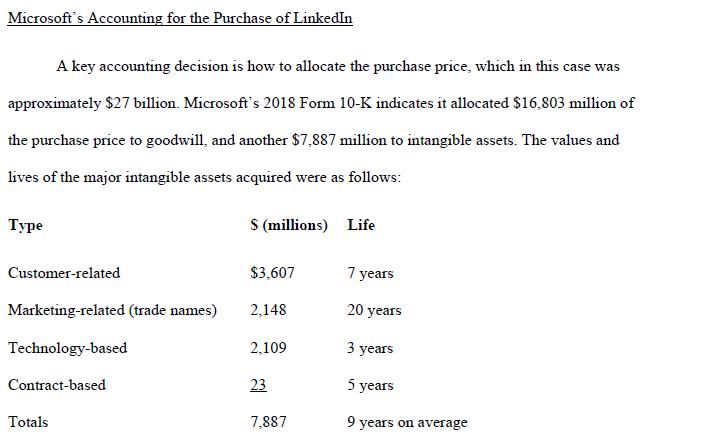

Microsoft's Accounting for the Purchase of LinkedIn A key accounting decision is how to allocate the purchase price, which in this case was approximately $27 billion. Microsoft's 2018 Form 10-K indicates it allocated $16,803 million of the purchase price to goodwill, and another $7,887 million to intangible assets. The values and lives of the major intangible assets acquired were as follows: S (millions) Life Customer-related $3,607 7 years Marketing-related (trade names) 2,148 20 years Technology-based 2,109 3 years Contract-based 23 5 years Totals 7,887 9 years on average

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Adjustments related to purchase accounting primarily amortization of intangible assets Acquisition c... View full answer

Get step-by-step solutions from verified subject matter experts