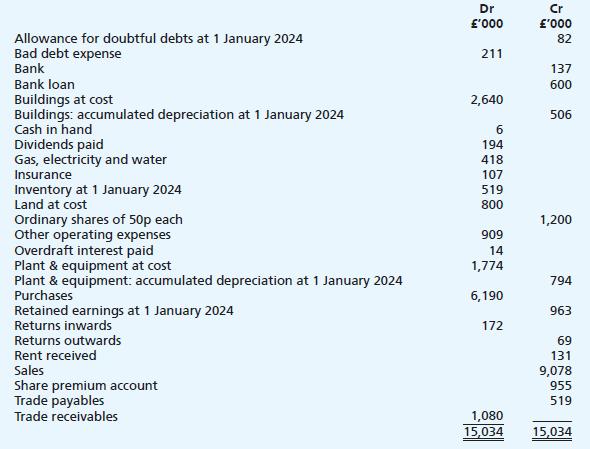

The trial balance for Rambaldi Ltd at 31 December 2024 is as follows: The figures in the

Question:

The trial balance for Rambaldi Ltd at 31 December 2024 is as follows:

The figures in the above trial balance include all transactions processed to date. The following issues also need to be considered before preparing the financial statements:

(i) Inventory at 31 December 2024 was counted and valued at a cost of £466,000.

(ii) Depreciation is to be charged as follows:

• Buildings - 5% straight line • Plant & equipment - 25% reducing balance

(iii) Insurance includes an annual premium of £57,000 paid that covers the twelve months to 30 April 2025.

(iv) Gas, electricity and water charges for December 2024, for which no bills have yet been received, are estimated to total £62,000.

(v) Based on a meticulous analysis of the company’s experience with debt collection, the allowance for doubtful debts is to be set to 5% of trade receivables.

(vi) On 28 December 2024, a supplier paid the £11,000 it owed for goods returned by Rambaldi Ltd in November. The supplier paid this £11,000 directly into Rambaldi Ltd’s bank account. The bank reconciliation at 31 December 2024 revealed that this receipt has yet to be entered in Rambaldi Ltd’s accounting records, although the original return was correctly recorded.

(vii) The bank loan was received on 1 October 2024 and is repayable in full on 1 September 2029.

Interest is charged at a fixed rate of 6% per year and is payable in two annual instalments, the first of which will be paid on 31 March 2025.

(viii) During December 2024, the land was valued at £1.5m by a professional firm of valuers. The directors of Rambaldi Ltd wish to incorporate this valuation in the year-end financial statements.

(ix) Corporation tax due on the profit for the year is estimated to be £248,000 (this estimate is unaffected by the eight matters above).

Required:

Prepare, in a format appropriate for external use, the income statement for the year ended 31 December 2024 for Rambaldi Ltd followed by its balance sheet as at that date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood