Lippman Company is evaluating a proposal to purchase a new piece of equipment. The cost of the

Fantastic news! We've Found the answer you've been seeking!

Question:

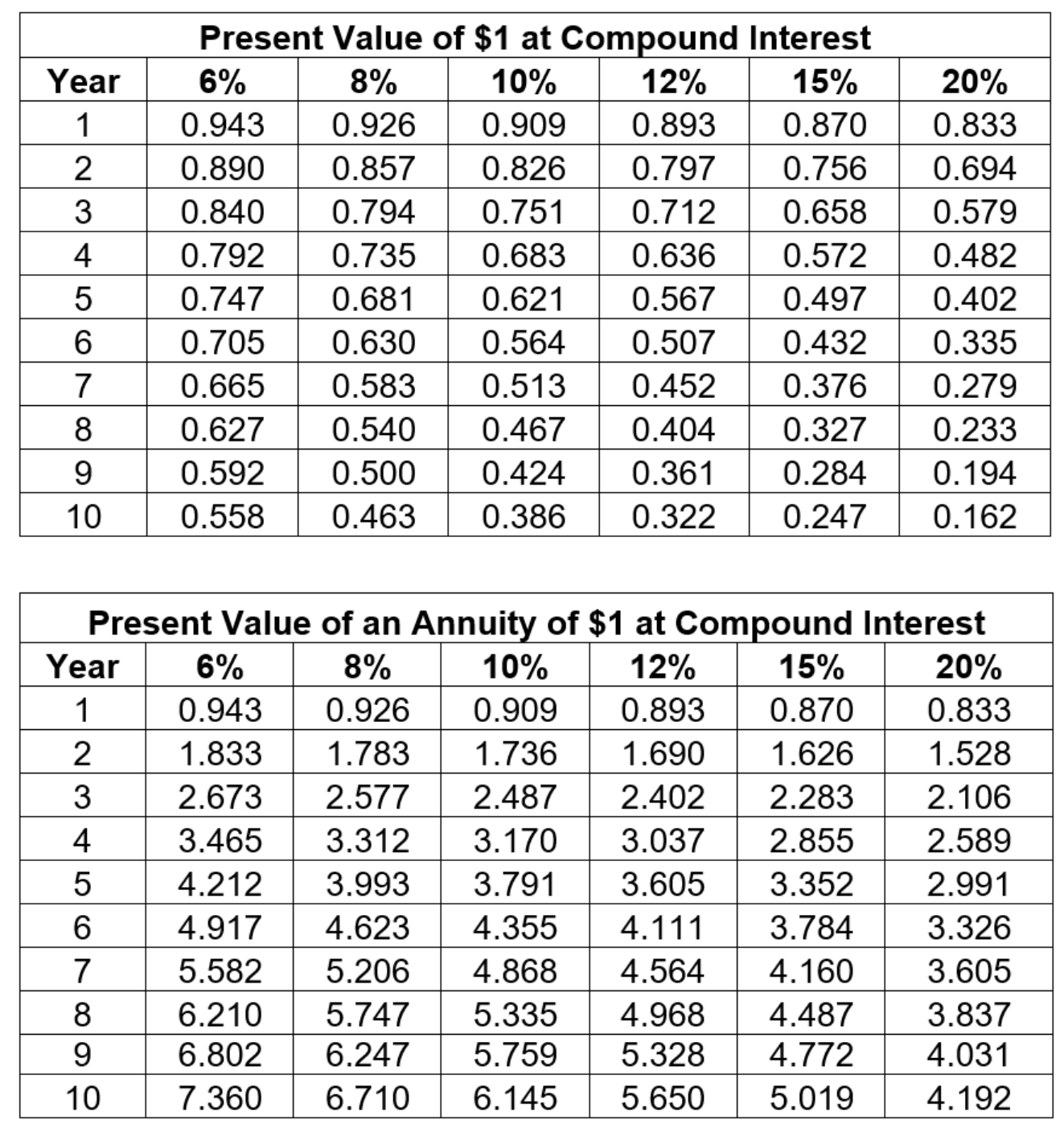

Lippman Company is evaluating a proposal to purchase a new piece of equipment. The cost of the equipment would be $65,325 and the company expects the investment would generate annual cash flows of $15,000 for the next 6 years. Using the appropriate present value table below, compute the internal rate of return (IRR) on this investment.

Transcribed Image Text:

Present Value of $1 at Compound Interest Year 6% 8% 10% 12% 15% 20% 1 0.943 0.926 0.909 0.893 0.870 0.833 2 0.890 0.857 0.826 0.797 0.756 0.694 3 0.840 0.794 0.751 0.712 0.658 0.579 4 0.792 0.735 0.683 0.636 0.572 0.482 5 0.747 0.681 0.621 0.567 0.497 0.402 6 0.705 0.630 0.564 0.507 0.432 0.335 7 0.665 0.583 0.513 0.452 0.376 0.279 8 0.627 0.540 0.467 0.404 0.327 0.233 9 0.592 0.500 0.424 0.361 0.284 0.194 10 0.558 0.463 0.386 0.322 0.247 0.162 Present Value of an Annuity of $1 at Compound Interest Year 6% 8% 10% 12% 15% 20% 1 0.943 0.926 0.909 0.893 0.870 0.833 2 1.833 1.783 1.736 1.690 1.626 1.528 3 2.673 2.577 2.487 2.402 2.283 2.106 4 3.465 3.312 3.170 3.037 2.855 2.589 5 4.212 3.993 3.791 3.605 3.352 2.991 6 4.917 4.623 4.355 4.111 3.784 3.326 7 5.582 5.206 4.868 4.564 4.160 3.605 8 6.210 5.747 5.335 4.968 4.487 3.837 9 6.802 6.247 5.759 5.328 4.772 4.031 10 7.360 6.710 6.145 5.650 5.019 4.192 Present Value of $1 at Compound Interest Year 6% 8% 10% 12% 15% 20% 1 0.943 0.926 0.909 0.893 0.870 0.833 2 0.890 0.857 0.826 0.797 0.756 0.694 3 0.840 0.794 0.751 0.712 0.658 0.579 4 0.792 0.735 0.683 0.636 0.572 0.482 5 0.747 0.681 0.621 0.567 0.497 0.402 6 0.705 0.630 0.564 0.507 0.432 0.335 7 0.665 0.583 0.513 0.452 0.376 0.279 8 0.627 0.540 0.467 0.404 0.327 0.233 9 0.592 0.500 0.424 0.361 0.284 0.194 10 0.558 0.463 0.386 0.322 0.247 0.162 Present Value of an Annuity of $1 at Compound Interest Year 6% 8% 10% 12% 15% 20% 1 0.943 0.926 0.909 0.893 0.870 0.833 2 1.833 1.783 1.736 1.690 1.626 1.528 3 2.673 2.577 2.487 2.402 2.283 2.106 4 3.465 3.312 3.170 3.037 2.855 2.589 5 4.212 3.993 3.791 3.605 3.352 2.991 6 4.917 4.623 4.355 4.111 3.784 3.326 7 5.582 5.206 4.868 4.564 4.160 3.605 8 6.210 5.747 5.335 4.968 4.487 3.837 9 6.802 6.247 5.759 5.328 4.772 4.031 10 7.360 6.710 6.145 5.650 5.019 4.192

Expert Answer:

Posted Date:

Students also viewed these accounting questions

-

TranscribedText: 9 Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare a schedule showing the estimated annual net...

-

Use the attached "words.txt" file to store the words along with their ranks in an AVL tree. Then provide the user the option to search for any word. If the word exists the program displays the rank...

-

Using the tables in Exhibits 26-3 and 26-4, determine the present value of the following cash flows, discounted at an annual rate of 15 percent. Exhibit 26-3: Present Value of $1 Payable in n Periods...

-

41.(6 pointa) In the following balanced reaction, magnesium metal (Mg) reacts with carbon dioxide gas (CO) o form solid magnesium exide (MgO) and solid carbon (C). How many grams of carbon dioxide...

-

The shipment will be accepted if we estimate that the proportion of cans that fail at a pressure of 90 or less is less than 0.001. Will this shipment be accepted?

-

Navigate to the threaded discussion and respond to the following: Use the four-step course methodology of understanding, analysis, evaluation, and application. Write contrasting deductive and...

-

Consider three villagers that live for ten periods and have linear, additive utility functions as follows: where c i n is the consumption (both of durable and nondurable) at time i of villager n, and...

-

Linkin Corporation is considering purchasing a new delivery truck. The truck has many advantages over the company's current truck (not the least of which is that it runs). The new truck would cost...

-

5 3 points Tablerock Corp. is interested in reviewing its method of evaluating capital expenditure proposals using the accounting rate of return method. A recent proposal involved a $101,000...

-

. Download the latest annual financial reports (income statement; statement of financial position and cash flow statement) for an organisation of your choice for at least the past 3 years. It can be...

-

Zaki Metal Company produces the steel wire that is used for the production of paper clips. In 2009, the first year of operations, Zaki produced 40,000 miles of wire and sold 30,000 miles. In 2010 ,...

-

Diamond Auto Supply distributes new and used automobile parts to local dealers throughout the Southeast. Diamonds credit terms are n/30. As of the end of business on July 31, the following accounts...

-

Cardinal Company sells carpeting. Over 75% of all carpet sales are on credit. The following procedures are used by Cardinal to process this large number of credit sales and the subsequent...

-

Logan Corporation manufactures two products with the following characteristics. If Logan's machine hours are limited to 2,000 per month, determine which product it should produce. Product 1 Product 2...

-

Blake and Roscoe are college friends planning a skiing trip to Aspen before the New Year. They estimated the following costs for the trip: Requirements 1. Blake suggests that the costs be shared...

-

gram and a standard deviation of 0.164 gram. Use a 0.05 significance level to test the claim of a cereal lobbyist that the mean for all cereals is less than 0.3 gram. sugar per gram of cereal) is...

-

Is the modified 5-question approach to ethical decision making superior to the modified moral standards or modified Past in approach?

-

Griffin Metals Co. has provided the following data: The selling price is expected to be \($300\) per tonne for the first six months and \($310\) per tonne thereafter. Variable costs per tonne are...

-

Highjinks Corporation's sales department has estimated revenue of 250,000 for your division. 60% of this will be achieved in the first half-year and 40% in the remaining half-year. Variable operating...

-

The total cost of goods sold for June is a. $103,500 b. $128,800 c. 57,500 d. $232,300

Study smarter with the SolutionInn App