Question: List the five financial statements and identify the elements/activities on each. 2. Who might use financial statements? List at least 3 examples of likely users/stakeholders

List the five financial statements and identify the elements/activities on each. 2. Who might use financial statements? List at least 3 examples of likely users/stakeholders and the types of decisions they might employ financial statements to aid them in making. 3. In the United States (US), what are the principles, concepts, rules, guidelines, methods, and procedures that govern financial reporting collectively referred to as? 4. Do all US companies have to use the rules referred to in Question #4 above when preparing their financial statements? Why or Why not? 5. Who has the regulatory power (legal authority) to establish the rules/accounting principles referred to in Question #4 above? Has this organization made any of these rules/accounting principles? Why or Why not? What is the mission of this organization? 6. Briefly describe the three primary US groups from the private sector that have been responsible for determining the rules referred to in Question #4 above (include the years of operations for each group). 7. Briefly define and describe the EITF. 8. Briefly define and describe the PCAOB. 9. Briefly explain the timeline and what the Codification (ASC) project is about and any impacts that it has on the accounting profession. (i.e., what is the codification project? Why this was project necessary (what is its purpose/goals)? What is the username and password for the Codification for this semester (see online student resources in Canvas)? What are the nine major areas in the Codification? 10. Independent auditors must provide dual opinions. What are these two opinions and what is the difference in them?

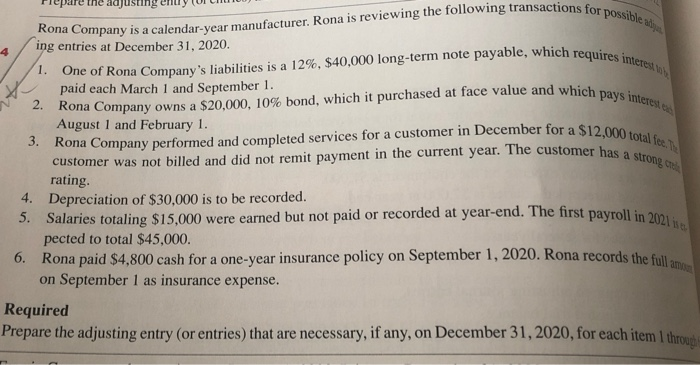

t Rona Company is a calendar-year manufacturer. Rona is reviewing the following transactions for possible aj One of Rona Company's liabilities is a 12%, $40,000 long-term note payable, which requires interest Rona Company owns a $20,000, 10% bond, which it purchased at face value and which pays interest Rona Company performed and completed services for a customer in December for a $12,000 total let. The customer was not billed and did not remit payment in the current year. The customer has a strong con 5. Salaries totaling $15,000 were earned but not paid or recorded at year-end. The first payroll in 2021. djusting 4 ing entries at December 31, 2020. 1. paid each March 1 and September 1. 2. August 1 and February 1. 3. rating. 4. Depreciation of $30,000 is to be recorded. a pected to total $45,000. 6. Rona paid $4,800 cash for a one-year insurance policy on September 1, 2020. Rona records the full amo on September 1 as insurance expense. Required Prepare the adjusting entry (or entries) that are necessary, if any, on December 31, 2020, for each item 1 through

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts