Question: Listed below are items that are treated differently for accounting purposes than they are for tax purposes. In the answer box, please indicate whether each

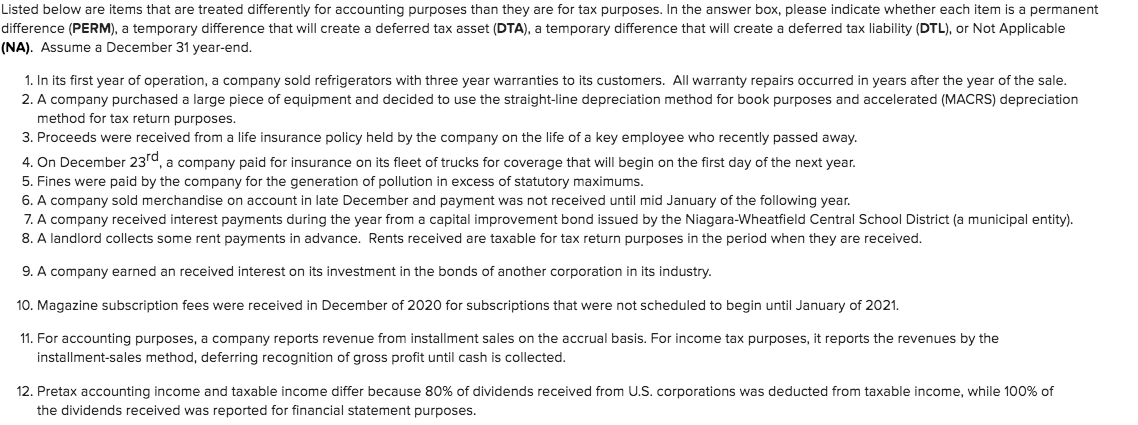

Listed below are items that are treated differently for accounting purposes than they are for tax purposes. In the answer box, please indicate whether each item is a permanent difference (PERM), a temporary difference that will create a deferred tax asset (DTA), a temporary difference that will create a deferred tax liability (DTL), or Not Applicable (NA). Assume a December 31 year-end. 1. In its first year of operation, a company sold refrigerators with three year warranties to its customers. All warranty repairs occurred in years after the year of the sale. 2. A company purchased a large piece of equipment and decided to use the straight-line depreciation method for book purposes and accelerated (MACRS) depreciation method for tax return purposes. 3. Proceeds were received from a life insurance policy held by the company on the life of a key employee who recently passed away. 4. On December 23, a company paid for insurance on its fleet of trucks for coverage that will begin on the first day of the next year. 5. Fines were paid by the company for the generation of pollution in excess of statutory maximums. 6. A company sold merchandise on account in late December and payment was not received until mid January of the following year. 7. A company received interest payments during the year from a capital improvement bond issued by the Niagara-Wheatfield Central School District (a municipal entity). 8. A landlord collects some rent payments in advance. Rents received are taxable for tax return purposes in the period when they are received. 9. A company earned an received interest on its investment in the bonds of another corporation in its industry. 10. Magazine subscription fees were received in December of 2020 for subscriptions that were not scheduled to begin until January of 2021. 11. For accounting purposes, a company reports revenue from installment sales on the accrual basis. For income tax purposes, it reports the revenues by the installment-sales method, deferring recognition of gross profit until cash is collected. 12. Pretax accounting income and taxable income differ because 80% of dividends received from U.S. corporations was deducted from taxable income, while 100% of the dividends received was reported for financial statement purposes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts