Question: Listed here are data for five companies. These data are for the companies' 2017 fiscal years. The market price per share is the closing

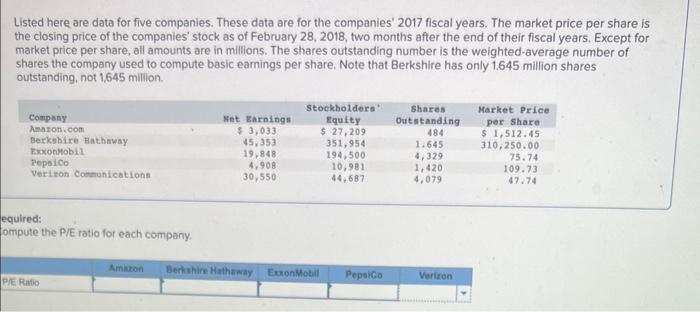

Listed here are data for five companies. These data are for the companies' 2017 fiscal years. The market price per share is the closing price of the companies' stock as of February 28, 2018, two months after the end of their fiscal years. Except for market price per share, all amounts are in millions. The shares outstanding number is the weighted-average number of shares the company used to compute basic earnings per share. Note that Berkshire has only 1.645 million shares outstanding, not 1,645 million. Company Amazon.com Berkshire Hathaway ExxonMobil PepsiCo Verizon Communications equired: ompute the P/E ratio for each company. P/E Ratio Net Earnings $ 3,033 45,353 19,848 4,908 30,550 Stockholders Equity $ 27,209 351,954 194,500 10,981 44,687 Amazon Berkshire Hathaway ExxonMobil PepsiCo Shares Outstanding 484 1.645 4,329 1,420 4,079 Verizon Market Price per Share $ 1,512.45 310,250.00 75.74 109.73 47.74

Step by Step Solution

There are 3 Steps involved in it

To calculate the PE ratio for each company we need to divide the ... View full answer

Get step-by-step solutions from verified subject matter experts