Question: Litho-Print is considering two possible capital structures, A and B, shown in the following table. Assume a 40% tax rate. a. Calculate two EBIT-EPS coordinates

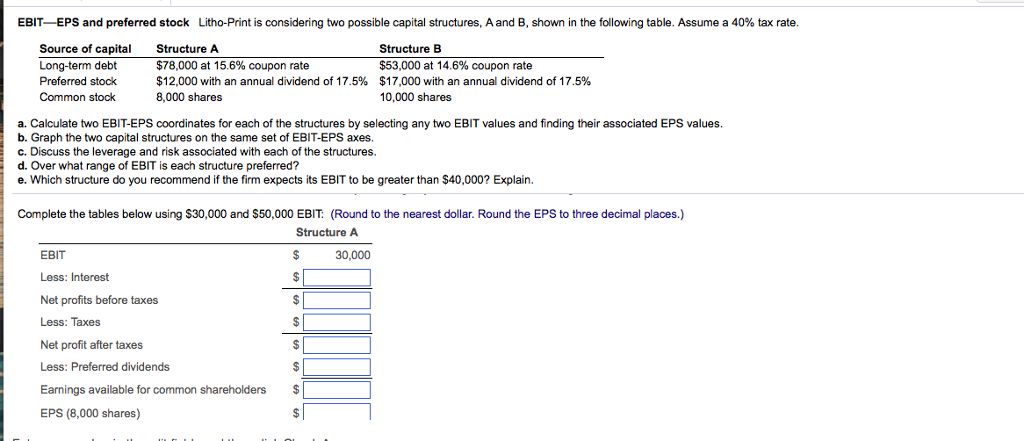

Litho-Print is considering two possible capital structures, A and B, shown in the following table. Assume a 40% tax rate. a. Calculate two EBIT-EPS coordinates for each of the structures by selecting any two EBIT values and finding their associated EPs values. b. Graph the two capital structures on the same set of EBIT-EPS axes. c. Discuss the leverage and risk associated with each of the structures. d. Over what range of EBIT is each structure preferred? e. Which structure do you recommend if the firm expects its EBIT to be greater than $40, 000? Explain. Complete the tables below using $30, 000 and $50, 000 EBIT: (Round to the nearest dollar. Round the EPS to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts