LLLis a company that sells modern equipment. To purchase a new equipment for your company from LLL,

Question:

LLLis a company that sells modern equipment. To purchase a new equipment for your company from LLL, you as a financial manager have narrowed down two equipment models which meet your performance requirements equally. However, the schedule of payments of two models are different.

Model A requires yearly payment of $15,000 for 5 years with the first payment to be made today.

Model B requires yearly payment of $15,500 for 5 years with the first payment to be made end of year 1.

Given yearly interest rate of 5.5%, which model would you recommend to purchase and why?

Question 3

Note: please explain in details

A financial company, ABC Inc. wants to earn an effective annual rate of 9% on its loan. If the interest is compounded monthly, what APR monthly compounding must ABC charge?

Another company CCC Inc. changes 8.8% APR quarterly compounded for its loan.

You are looking to take a loan and you only have 2 choices, either ABC or CCC. Which one will you choose and why?

Question 4

Note: please explain in details

You want to buy a property in city of Vancouver and the purchase price is $440,000. You will be making a down payment of 20% of the purchase price, and you will be taking a mortgage for the rest of the amount.

For the mortgage, your bank quoted you an interest rate, APR semi-annual compounding with 25 year amortization. And you have converted the rate to APR monthly compounding of 1.8% APR monthly compounding.

What would be the monthly mortgage payment for the above purchase?

How much do you owe the bank after 1 year of mortgage payment?

Question 5

Note: please explain in details

YYY Inc. issued 12% semi-annual coupon bond with maturity of 8 years and face value $1,000. What is the price you are willing to pay for YYY Inc. bond if the yield to maturity is 10%?

What would the % change in price for YYY, if the yield decreases to 9%.

ZZZ Inc. issued a similar bond (same time to maturity, face value and yield at 10% as in YYY) but with a higher coupon rate. Will the % change in price for ZZZ higher or lower than YYY if the yield decreases to 9%?

Question 6

Inn Tech (IT) company is getting well known among analysts due to its planned dividend payment. The company plans to pay $0.80 a share next year and $1.60 a share the following year. After that, it plans to pay constant $2 per share indefinitely.

What is the price of IT's stock today if the market rate of return on similar stock is 12%? What would be the impact on the price of IT stock if the market is uncertain of whether the company will be providing mentioned dividends in the future, due to unfavorable economic situation? Please explain.

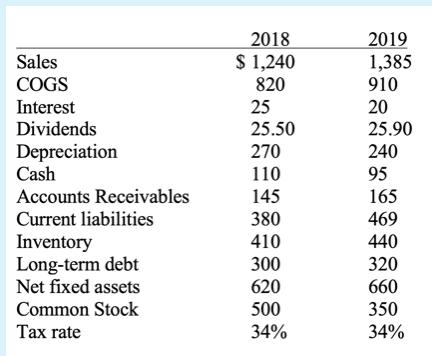

Question 7, please see picture attached

and answer: what is the operating cash flow, and addition to net working capital for 2019(please show formula and details)

what can the company possibly do to increase its cash flow from assets in the future? please explain

Question 8

You are considering the following two mutually exclusive projects.

Project 1: Cash Flow in Year 1: $21,500, Year 2: $13,500, Year 3: $10,000. For this project 1, you need to buy a machine in the beginning (Year 0) for $36,000 and you can sell it for $3,500 at the end of its useful life in Year 3.

Project 2: Cash Flow in Year 1: $13,690, Year 2: $11,500, Year 3: $25,300. For this project 2, you need to buy a machine in the beginning (Year 0) for $36,000 but there is no salvage value at the end of its useful life in Year 3.

For each project, you require 10% rate of return. And you have a limited investment capital of $36,000.

Questions:

Calculate NPV and IRR of each project. Should you invest in one of the two projects? If yes, which one and why?

What is the payback period for each project? Should you use payback period in your investment decision? Why or Why not?

Question 9:

One of your friends is thinking of purchasing a condo one year after graduation. Your friend heard that you are about to your financial management course and called to seek your advice whether to continue to rent or buy a condo. What are the relevant cash flows you would consider in your analysis and what would be your advice?

Question 10. If I know the internal rate of return (IRR) of a project, I can make the investment decision by comparing it against my expected return on that project". Do you agree or disagree with the above statement? Please explain in details

Excellence in Business Communication

ISBN: 978-0136103769

9th edition

Authors: John V. Thill, Courtland L. Bovee