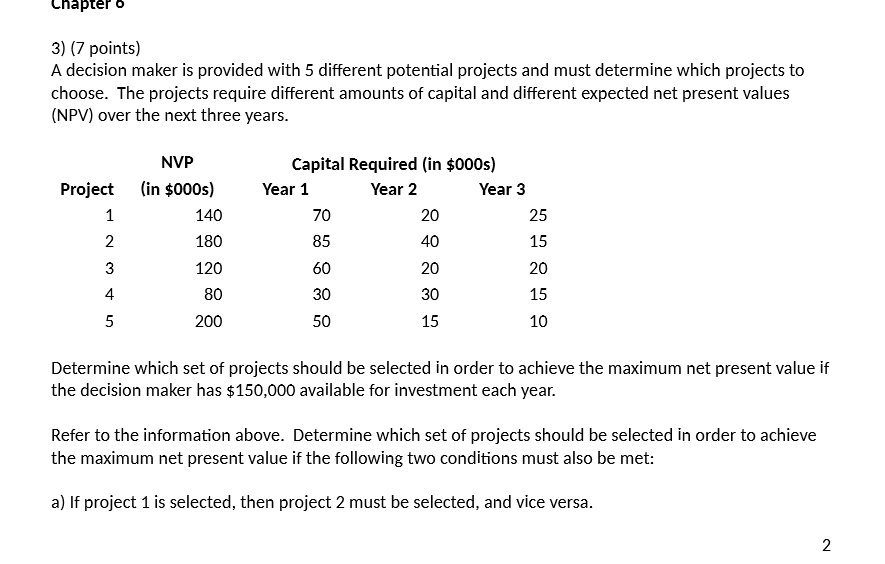

Question: Lnapter o 3) (7 points) A decision maker is provided with 5 different potential projects and must determine which projects to choose. The projects require

Lnapter o 3) (7 points) A decision maker is provided with 5 different potential projects and must determine which projects to choose. The projects require different amounts of capital and different expected net present values {NP'v'} over the next three years. NVP Capital Required (in $0005) Project l[in $0005} Year 1 Year 2 Year 3 1 140 70 20 25 2 130 85 40 15 3 120 60 2O 20 4 BO 30 30 15 5 200 50 15 10 Determine which set of projects should be selected in order to achieve the maximum net present value if the decision maker has $150,000 available for investment each year. Refer to the information above. Determine which set of projects should be selected in order to achieve the maximum net present value if the following two conditions must also be met: a} If project 1 is selected, then project 2 must be selected, and vice versa

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts