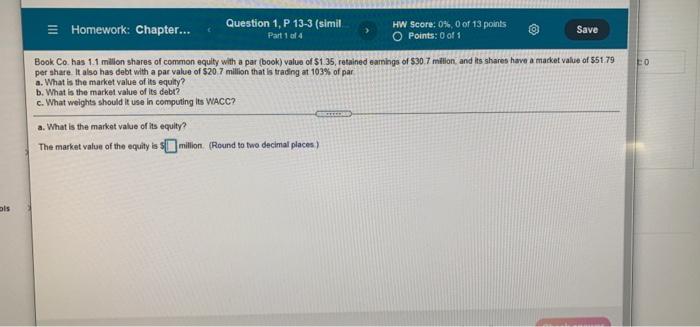

Question: LO Homework: Chapter... Question 1, P 13-3 (simil HW Score: 0%, 0 of 13 points Save Part 1 of 4 O Points: 0 of 1

LO Homework: Chapter... Question 1, P 13-3 (simil HW Score: 0%, 0 of 13 points Save Part 1 of 4 O Points: 0 of 1 Book Co has 11 million shares of common equity with a par book) value of 1.35, retained earnings of $30.7 milion, and its shares have a market value of 551 79 per share. It also has debt with a par value of $20 7 million that is trading at 103% of par a. What is the market value of its equity? b. What is the market value of its debt? c. What weights should it use in computing Its WACC? TEORE a. What is the market value of its equity? The market value of the equity is million (Round to two decimal place) als

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts