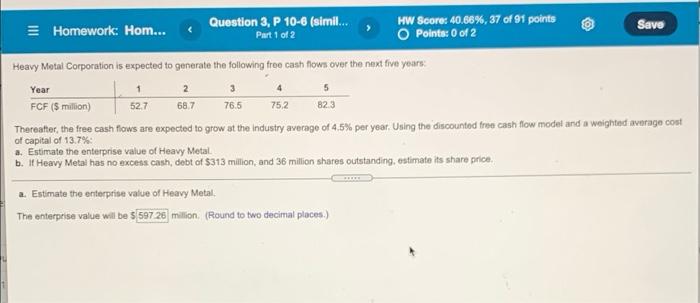

Question: solve a-b please. thank you! 4 Homework: Hom... Question 3, P 10-6 (simil... HW Score: 40.66%, 37 of 91 points Save Part 1 of 2

4 Homework: Hom... Question 3, P 10-6 (simil... HW Score: 40.66%, 37 of 91 points Save Part 1 of 2 O Points: 0 of 2 Heavy Metal Corporation is expected to generate the following free cash flows over the next five years Year 2 3 FCF ($ million) 52.7 687 76.5 752 823 Thereafter the free cash flows are expected to grow at the Industry average of 4,5% per year. Using the discounted from cash flow model and a weighted average cost of capital of 13.7% a. Estimate the enterprise value of Heavy Metal b. I Heavy Metal has no excess cash, debt of $313 million, and 36 million shares outstanding, estimate its share price 2. Estimate the enterprise value of Heavy Metal, The enterprise value will be 5 597 26 million (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts