Question: LO S7-5. (Learning Objective 4: Computing depreciation by three methods-first year only) Assume that at the beginning of 20X6, AirAsia, a regional airline operating predominantly

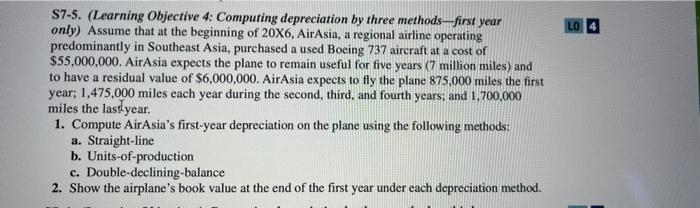

LO S7-5. (Learning Objective 4: Computing depreciation by three methods-first year only) Assume that at the beginning of 20X6, AirAsia, a regional airline operating predominantly in Southeast Asia, purchased a used Boeing 737 aircraft at a cost of $55,000,000. AirAsia expects the plane to remain useful for five years (7 million miles) and to have a residual value of $6,000,000. AirAsia expects to fly the plane 875,000 miles the first year: 1,475,000 miles each year during the second third, and fourth years; and 1.700.000 miles the lastyear. 1. Compute AirAsia's first-year depreciation on the plane using the following methods: a. Straight-line b. Units-of-production c. Double-declining-balance 2. Show the airplane's book value at the end of the first year under each depreciation method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts