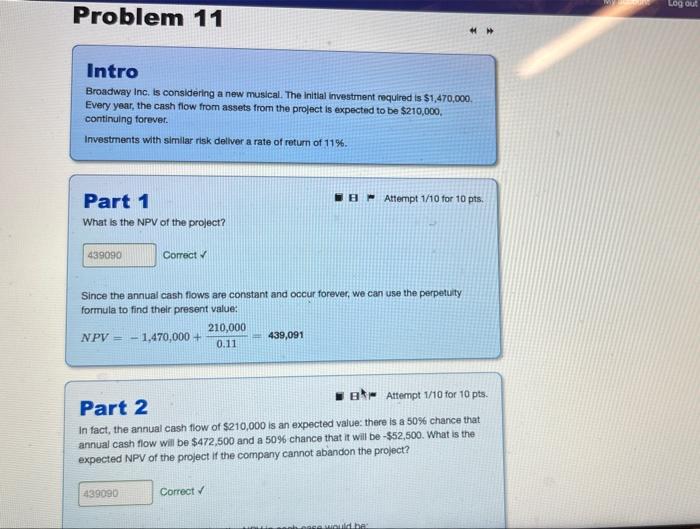

Question: Log out Problem 11 Intro Broadway Inc. is considering a new musical. The initial investment required is $1,470,000 Every year, the cash flow from assets

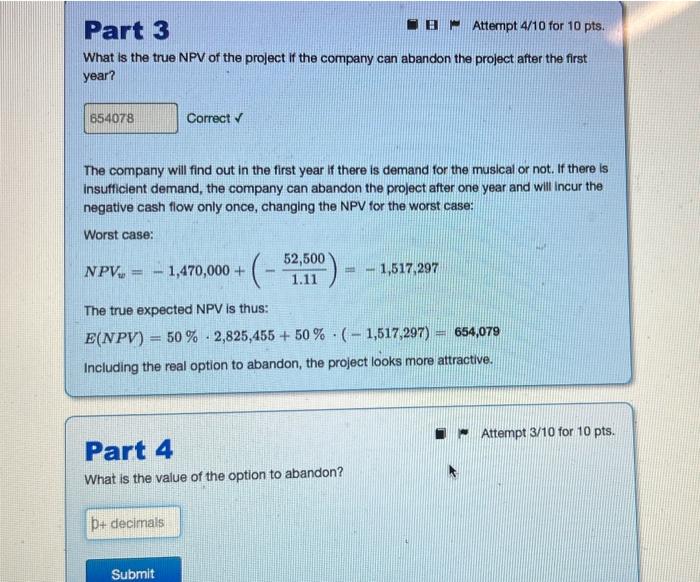

Log out Problem 11 Intro Broadway Inc. is considering a new musical. The initial investment required is $1,470,000 Every year, the cash flow from assets from the project is expected to be $210,000, continuing forever. Investments with similar risk deliver a rate of return of 11%. B Attempt 1/10 for 10 pts. Part 1 What is the NPV of the project? 439090 Correct Since the annual cash flows are constant and occur forever, we can use the perpetuity formula to find their present value: 210,000 NPV = - 1,470,000+ 439,091 0.11 Part 2 Attempt 1/10 for 10 pts. In fact, the annual cash flow of $210,000 is an expected value there is a 50% chance that annual cash flow will be $472,500 and a 50% chance that it will be - $52,500. What is the expected NPV of the project if the company cannot abandon the project? 439090 Correct Daribe Part 3 Attempt 4/10 for 10 pts. What is the true NPV of the project if the company can abandon the project after the first year? 654078 Correct The company will find out in the first year if there is demand for the musical or not. If there is insufficient demand, the company can abandon the project after one year and will incur the negative cash flow only once, changing the NPV for the worst case: Worst case: 52,500 NPV = 1,470,000+ 1,517 297 1.11 - The true expected NPV is thus: E(NPV) = 50 % -2,825,455 + 50 % (-1,517,297) = 654,079 Including the real option to abandon, the project looks more attractive. - Attempt 3/10 for 10 pts. Part 4 What is the value of the option to abandon? + decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts