Question: Please show the calculation step buy step QUESTION 2 (25 marks) Dewandas Berhad is considering investing in a new project and has the following capital

Please show the calculation step buy step

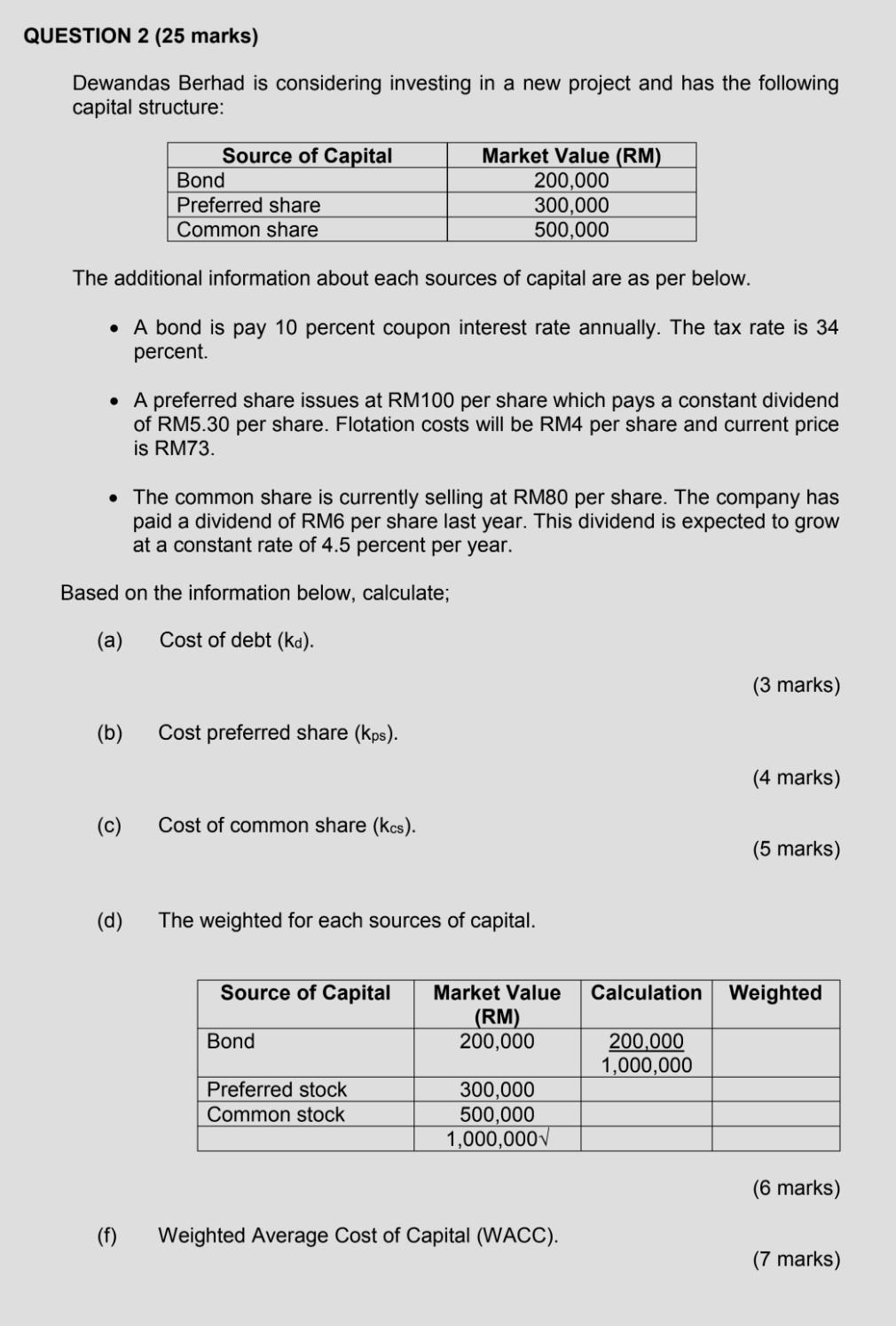

QUESTION 2 (25 marks) Dewandas Berhad is considering investing in a new project and has the following capital structure: Source of Capital Bond Preferred share Common share Market Value (RM) 200,000 300,000 500,000 The additional information about each sources of capital are as per below. A bond is pay 10 percent coupon interest rate annually. The tax rate is 34 percent. A preferred share issues at RM100 per share which pays a constant dividend of RM5.30 per share. Flotation costs will be RM4 per share and current price is RM73. The common share is currently selling at RM80 per share. The company has paid a dividend of RM6 per share last year. This dividend is expected to grow at a constant rate of 4.5 percent per year. Based on the information below, calculate; (a) Cost of debt (kd). (3 marks) (b) Cost preferred share (kps). (4 marks) (c) Cost of common share (kcs). (5 marks) (d) The weighted for each sources of capital. Source of Capital Calculation Weighted Market Value (RM) 200,000 Bond 200,000 1,000,000 Preferred stock Common stock 300,000 500,000 1,000,000 (6 marks) (f) Weighted Average Cost of Capital (WACC). (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts