Question: Look at the DDM example below. Now look up electric utility company Eversource Energy (formerly Northeast Utilities), symbol ES, on Bloomberg. Using the data available

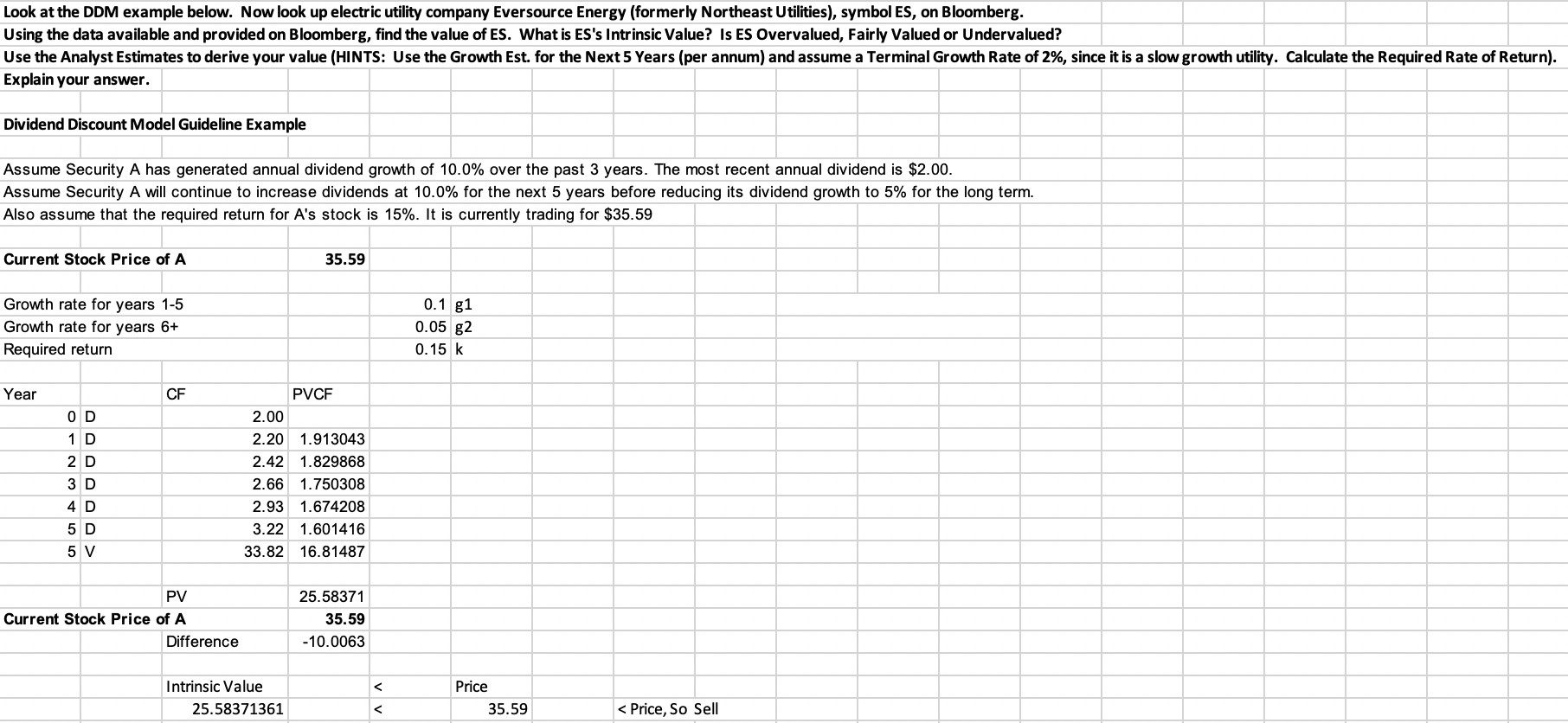

Look at the DDM example below. Now look up electric utility company Eversource Energy (formerly Northeast Utilities), symbol ES, on Bloomberg. Using the data available and provided on Bloomberg, find the value of ES. What is ES's Intrinsic Value? Is ES Overvalued, Fairly Valued or Undervalued? Use the Analyst Estimates to derive your value (HINTS: Use the Growth Est. for the Next 5 Years (per annum) and assume a Terminal Growth Rate of 2%, since it is a slow growth utility. Calculate the required Rate of Return). Explain your answer. Dividend Discount Model Guideline Example Assume Security A has generated annual dividend growth of 10.0% over the past 3 years. The most recent annual dividend is $2.00. Assume Security A will continue to increase dividends at 10.0% for the next 5 years before reducing its dividend growth to 5% for the long term. Also assume that the required return for A's stock is 15%. It is currently trading for $35.59 Current Stock Price of A 35.59 Growth rate for years 1-5 Growth rate for years 6+ Required return 0.1 g1 0.05 g2 0.15 k Year CF OD 1 D 2 D 3 D PVCF 2.00 2.20 1.913043 2.42 1.829868 2.66 1.750308 2.93 1.674208 3.22 1.601416 33.82 16.81487 4 D 5 D 5 V PV Current Stock Price of A Difference 25.58371 35.59 -10.0063

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts