Question: Look at the example and do the problem. You should solve the problem as same as the example. include all the steps and the charts

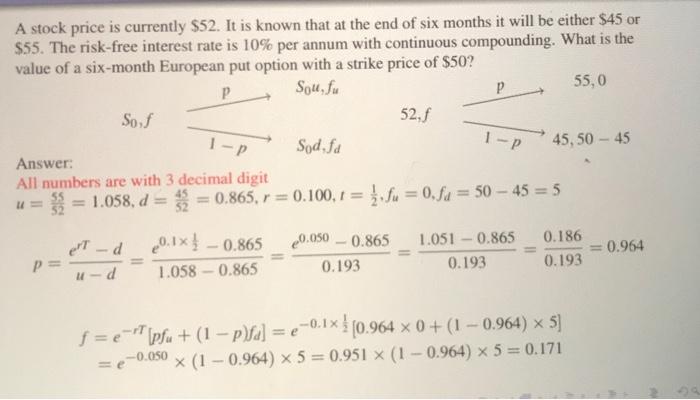

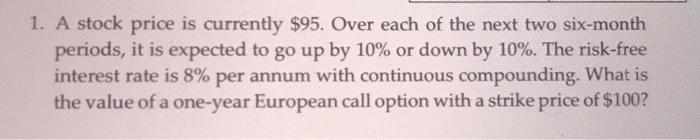

A stock price is currently $52. It is known that at the end of six months it will be either $45 or $55. The risk-free interest rate is 10% per annum with continuous compounding. What is the value of a six-month European put option with a strike price of $50? Sou,fu 55,0 Sos 52, Sod.fd 45,50 - 45 Answer: All numbers are with 3 decimal digit 1.058, 0 = 0.865, r = 0.100.1 = fu = 0,fa = 50 - 45 = 5 1-P 1-p = et d 20.1x} - 0.865 1.058 -0.865 20.050 - 0.865 0.193 1.051 - 0.865 0.193 0.186 0.193 0.964 P= ud f = e-pfu + (1 - p\a] = e-014 | (0.964 x 0 + (1 - 0.964) * 5) = e-0.050 x (1 0.964) * 5 = 0.951 x (1 -0.964) x 5 = 0.171 1. A stock price is currently $95. Over each of the next two six-month periods, it is expected to go up by 10% or down by 10%. The risk-free interest rate is 8% per annum with continuous compounding. What is the value of a one-year European call option with a strike price of $100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts