Question: look at the following example. - Frank is calculating the monthly mortgage payment for a home buyer (APR=3.8%; principal =$150000; term =30 years). - Given

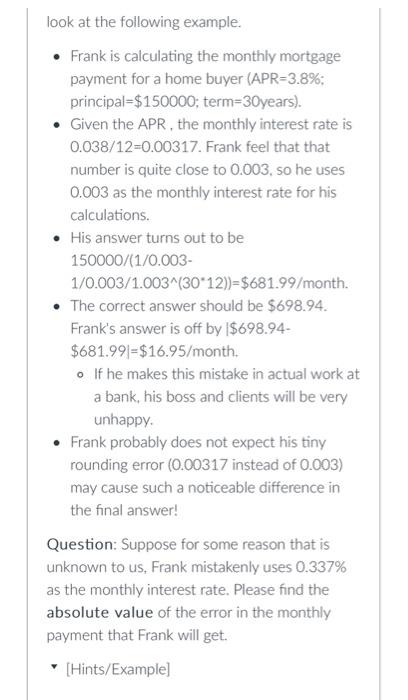

look at the following example. - Frank is calculating the monthly mortgage payment for a home buyer (APR=3.8\%; principal =$150000; term =30 years). - Given the APR , the monthly interest rate is 0.038/12=0.00317. Frank feel that that number is quite close to 0.003, so he uses 0.003 as the monthly interest rate for his calculations. - His answer turns out to be 150000/(1/0.003 1/0.003/1.003(3012))=$681.99/ month. - The correct answer should be $698.94. Frank's answer is off by 1$698.94 $681.991=$16.95/ month. - If he makes this mistake in actual work at a bank, his boss and clients will be very unhappy. - Frank probably does not expect his tiny rounding error (0.00317 instead of 0.003) may cause such a noticeable difference in the final answer! Question: Suppose for some reason that is unknown to us, Frank mistakenly uses 0.337% as the monthly interest rate. Please find the absolute value of the error in the monthly payment that Frank will get. - [Hints/Example]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts