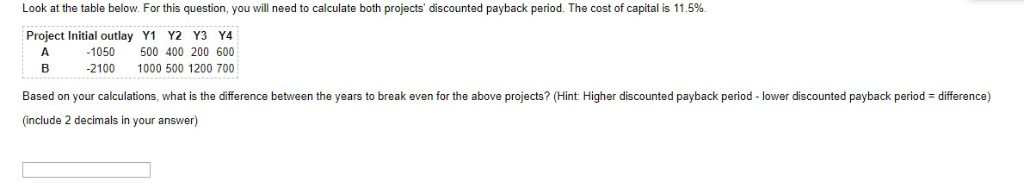

Question: Look at the table below. For this question, you will need to calculate both projects, discounted payback period. The cost of capital is 11.5% Project

Look at the table below. For this question, you will need to calculate both projects, discounted payback period. The cost of capital is 11.5% Project Initial outlay Y1 Y2 Y3 Y4 1050 500 400 200 600 B 2100 1000 500 1200 700 Based on your calculations, what is the difference between the years to break even for the above projects? (Hint: Higher discounted payback period - lower discounted payback period difference) (include 2 decimals in your answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts